Spare change investor start-up expands into Thailand and Vietnam

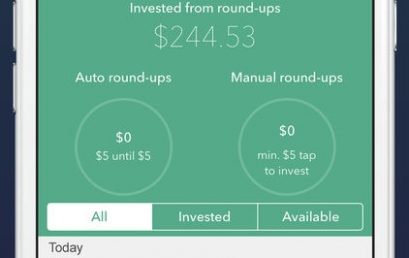

Raiz allows users to round-up everyday purchases and pool their spare change to invest in equities, bonds and other securities.

Australian FinTech company profile #31 – WLTH

WLTH simplifies the way everyday Australians manage their finances, allowing them to track all their assets and liabilities in one simple to use platform.

Verrency completes $10 million Series A raise

Australian payment innovation company, Verrency, closes a $10 million Series A funding round, bringing total investment in the company to over $20 million

The Winners of the 2019 Fintech Business Awards have been announced

The Winners of the 2019 Fintech Business Awards have been announced. Congratulations to all the Australian fintech companies and leaders – well done! Individual categories Femtech Leader of the Year Jodi Stanton – SendGold Fintech Entrepreneur of the Year Ruth Hatherley – Moneycatcha Fintech Mentor of the Year Peta Tilse – Sophisticated Access Fintech Thought Leader of the Year Charmian Holmes – The Fold Legal Fintech Business Excellence Award (Individual) Ruth Hatherley – Moneycatcha Company categories Accounting Innovator of the Year Class Limited Compliance Innovator of the Year Advice RegTech Financial Advice Innovator of the Year Myprosperity Fintech Start-Up Business of the Year Trade Ledger Insurance Innovator of the Year […]

Make money while you sleep with technology and automation

Technology and automation are delivering Australians new ways to earn money while they’re sleeping.There has been rapid growth in new savings and investment products that allow people to start building wealth with a few taps of their smartphone or computer keyboard, then let the power of compound interest do its work.Here are four ways to get rich automatically. ROUNDING UP Fast-growing financial technology company Raiz automatically moves its clients’ spare change to an investment portfolio or superannuation. It rounds up every transaction to the nearest dollar, and now manages more than $270 million of people’s funds, up 60 per cent in the past nine months. Raiz managing director George Lucas […]

The finalists of the 2019 Fintech Business Awards have been announced

The finalists of the 2019 Fintech Business Awards have been announced. Congratulations and good luck to all the finalists – both individuals and companies.

Is it time Australian investors bought into the fintech story?

By George Lucas, MD/CEO, Raiz Invest Tell Australian investors that a hole in the ground could prove to be the next El Dorado and they will fall over themselves to push a one-cent share into the stratosphere. But tell them about an exciting high-tech venture that is disrupting the market and you can hear the audible yawns. Raiz Invest’s former parent company, the privately-owned US company Acorns, recently raised $US105 million ($A145million) to continue to fund its operation. The Wall Street Journal reports this gives Acorns a $US860 million ($A1.186 billion) valuation. CNBC reports that Acorns US has more than 4.5 million sign-ups, 2.1 million investment accounts and circa $US1.2 […]

How to take a FinTech through an IPO

Raiz Invest (previously Acorns Australia) launched in 2016, quickly amassing close to one million users. George Lucas, CEO is one of the more experienced founders in the FinTech NextGen series. Many CEO’s in financial services struggle to relate to the Millennial market, not so George and his Raiz Invest team. Discover his secrets in this interview with Dexter Cousins of Tier One People. How does Raiz Invest work? George:Raiz Invest is a micro investing platform, enabling users to invest in the markets with as little as five dollars all through an app on your mobile phone. Put simply, we enable users to save in the background of life. Raiz educates a potential […]