NextGen and CommBank enable Open Banking for mortgage brokers

NextGen has announced that the Commonwealth Bank of Australia has become one of the first lenders to enable Open Banking for mortgage brokers.

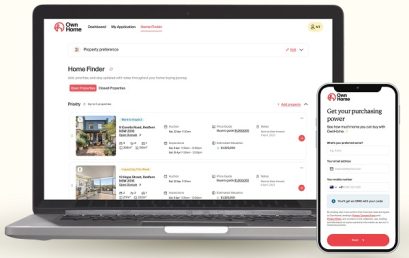

OwnHome launches Australia’s first 0% deposit home loan option to get more people onto the property ladder

CBA-backed OwnHome today launched the Deposit Boost Loan – an Australian first that will help aspiring buyers secure a bank loan with 0% deposit.

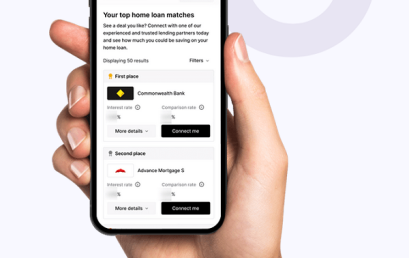

Joust partners with Lendela to expand financial empowerment

Home loan marketplace Joust have announced its partnership with Lendela, a prominent player in the personal loan industry.

Pioneering Australian fintech Joust navigates current market conditions with restructure and sale process

Joust announces a series of strategic initiatives aimed at bolstering the company’s financial health and repositioning the business in the current market

Bridging loan specialist Bridgit sees market changes and adapts product structure to meet new demand

Bridgit has been closely monitoring the needs of Australian homeowners alongside the recent market fluctuations.

Non-bank lender Firstmac prices $1.2 billion Residential Mortgage-Backed Securities issue

Firstmac has dispelled fears about weakness in the Residential Mortgage-Backed Securities (RMBS) market by successfully pricing a $1.2 billion issue at a tight yield.

Moneysoft delivers open banking win for financial advisers and superannuation funds, powered by Envestnet | Yodlee

Moneysoft is working with accredited data recipient Envestnet® | Yodlee® to access open banking data under Australia’s Consumer Data Right (CDR).

Compare n Save integrates with MacroBusiness to provide a hassle-free loan comparison solution

Compare n Save, a mortgage broking Fintech, have launched its integration with Australia’s leading business and investment blog, MacroBusiness.