UBank launches AI mortgage application assistant

A new artificial intelligence-powered mortgage application assistant will soon be able to answer customer questions in natural language, UBank has announced. UBank has revealed that its new AI-powered digital home loan application assistant, called Mia (short for My Interactive Agent), will start answering more than 300 common customer questions in real time from late February. The NAB subsidiary, which worked with FaceMe to develop Mia, said customers will be able to converse in natural language with the AI assistant via their desktop or mobile devices at any time about their mortgage applications. For example, customers could ask about what the variable rate of a loan is or what classifies as […]

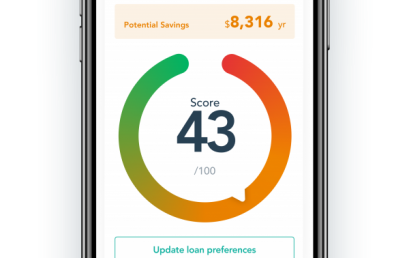

Know whether your bank is giving you a good home loan deal with uno’s loanScore

Australian fintech uno Home Loans is empowering customers to take back control with the launch of loanScore.

ANZ Bank buys into online mortgage broker Lendi

ANZ Banking Group has taken a strategic stake in online home loans platform Lendi. Street Talk understands ANZ paid close to $40 million for a minority stake, to become Lendi’s second largest strategic shareholder behind fellow Australian financial services giant Macquarie Group. Importantly for Lendi, which has 37 banks and lenders on its open home loans platform, the business will continue to be run independently and at arms length to its strategic investors. ANZ will not be given a board seat, as consistent with Lendi’s treatment of Macquarie and other strategic investors including Pepper. It is understood ANZ agreed to write the cheque after spending much of last year talking […]

Fintech joins express loans partnership

A digital mortgage service fintech has announced it will join a partnership to create fast, paperless home loans. Tic:Toc and Bendigo Bank announced recently they would be teaming up to offer “express” loans. Now, legal fintech LeadPoint, which specialises in providing automated home loan documentation, has announced it would join them. The group has generated more than 50,000 home loan contracts through its platform since it launched in 2013. LeadPoint’s involvement in Bendigo Bank Express is the next phase of LeadPoint’s partnership with Tic:Toc loans, which already offers ‘webmortgages’ loan documentation as part of its instant home loan assessment and approval platform. LeadPoint uses its proprietary platform to produce digital […]

CashDeck app Wealth Desk is a game changer for mortgage brokers

CashDeck have released their Financial Fitness Tracker app called Wealth Desk for Apple and Android and it’s set to be a game changer for the 65% of mortgage brokers who find marketing and lead generation a challenge. The app is a simple tool that helps clients prepare for the lending process. But, for the broker, it acts as a sales tool, an ice-breaker, a database builder and a way to get their business onto thousands of smartphones. “Twelve months ago we set ourselves three goals”, said Owen Joyce, CashDeck’s Chief Commercial Officer. “One, build an app that is useful to its user in less than two minutes after they download […]

Fintech drops interest rates

A fintech has announced rate cuts across its investor home loans, including a 32 basis point reduction to its variable interest only product. Tic:Toc said the decision comes at a time of falling investor lending. The group has noticed a 33% drop in investment lending in the last quarter to November 2018. According to figures from the Australian Bureau of Statistics, the value of investment loans has also dropped by more than 20% over the last year and investment housing commitments fell by 0.9%. Tic:Toc founder and CEO, Anthony Baum, said now may be the opportune time for investors to secure a competitive rate via Tic:Toc’s digital platform. He said, […]

Home loan fintech raises $25m

A fintech start-up is celebrating a $25million raise as it continues on its pathway to becoming Australia’s “most innovative home loan provider”. Athena Home Loans, which is still in its pilot phase, has closed its most recent Series B raise led by Square Peg Capital. Industry super fund Hostplus and venture firm AirTree also joined the round, taking the group’s total capital raised to date to $45m. The Series B raise comes six months after the company announced a Series A fund raise led by Macquarie Bank and Square Peg Capital and three months after announcing a strategic partnership with Resimac Group. Powered by Australia’s first cloud native digital mortgage […]

Bendigo embraces fintech to offer instant home loans

In its bid to improve its services for potential mortgage clients, Bendigo Bank has partnered with fintech provider Tic:Toc to offer instant home loans starting early next year. The partnership enables Bendigo to utilize Tic:Toc’s platform in offering an automated assessment on home-loan applications. The bank was the first Australian lender to offer a digital home-loan application and assessment process under its own brand. Tic:Toc first launched the platform in July 2017, offering a streamlined digital fulfilment process. Tic:Toc founder and CEO Anthony Baum said the platform promises to cut expenses needed to process and deliver home-loan applications, resulting in cost efficiencies on the side of the lenders. “There’s actually […]