Rocket Mortgage execs share parallel journey at Lendi Group conference

Lendi Group welcomed senior leaders from Rocket Mortgage to headline its Thrive 25 broker conference in Sydney last week.

Lendi Group shares bold vision for the future of Aussie business

Lendi Group CEO and Co-Founder David Hyman has shared the company’s bold new vision to transform Aussie from a linear mortgage broking business.

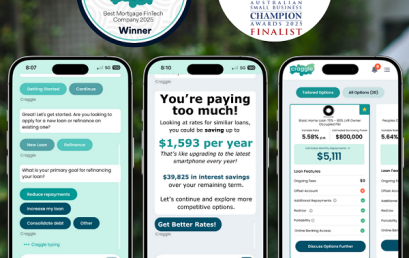

From Fairness to Futurism: How Craggle’s Generative AI is pioneering the next Financial Revolution

Craggle are changing how the world thinks about home lending—by defining a future where everyone gets speed, simplicity and transparency.

AI-powered mortgage platform Craggle named Best Mortgage FinTech Company 2025

Craggle has been named Best Mortgage FinTech Company 2025 in the prestigious Australian Enterprise Awards, presented by Corporate Vision.

New sales and partnerships heads at Quickli point to strong growth

Australia’s leading mortgage serviceability platform, Quickli, announce the appointment of two new leaders to its team reinforcing significant growth.

Craggle’s AI-driven innovation in Financial Services recognised on the national stage

Innovation that truly reshapes the financial services industry is great to see, and Craggle is doing just that.

Apply for a home loan in five minutes: LoanOptions.ai launches flagship home loan technology on subscription model

Award-winning and leading loan matching technology provider and asset finance broker LoanOptions.ai has unveiled its innovative home loan technology.

Craggle launches AI home loans for self-employed Australians

Craggle, the AI-powered mortgage broker committed to fairness and transparency, announce the expansion of its services to better support self-employed Australians.