Australia’s mortgage brokers expect house prices to rise: Hashching survey

Hashching has revealed that almost 60% of survey respondents agree that house prices will exceed 20% growth by the end of the calendar year.

Lending is surging – But what does it all mean?

A comprehensive insight into lending indicators by Savvy late last August showed that housing lending is booming.

Bluestone Home Loans’ brokers reap digital revamp rewards

Bluestone Home Loans has introduced NextGen.Net’s ApplyOnline Application Centre as a key integration in their newly overhauled digital lending platform.

Lendi sharpens its home loan process with Google Cloud

Australian fintech Lendi is using Google Cloud capabilities to automate its mortgage origination process as it works towards a same day approval for a loan.

Cashback boom but should you bank one?

Analysis by Mozo.com.au has found a boom in cashback offers during the pandemic as lenders try to appeal to home loan customers who are spoilt for choice.

86 400 partners with FAST Group – almost 90% of Aussie brokers now have access to its home loans

86 400 has announced a new partnership with FAST Group to bolster its broker network and help even more Australians secure a smarter home loan, faster.

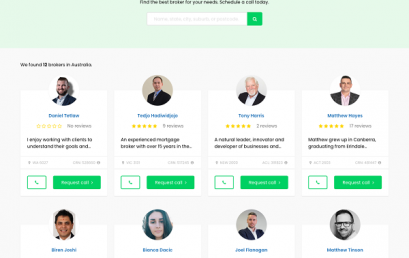

Effi announces new partnership with global comparison site Finty

Effi has announced a partnership with global comparison site Finty, which will enable brokers to reach more potential customers throughout Australia.

86 400 introduces game-changing loan to value ratio mortgages

Australia’s first smartbank, 86 400, has today introduced a new 85% Loan to Value Ratio (LVR) tier for Owner Occupied, Principal and Interest home loans.