New Hashching survey shows the race is on to lock in fixed term interest rates

Mortgage broker platform Hashching has revealed more than 8 in 10 Australians are looking to lock in fixed term interest rates than this time last year.

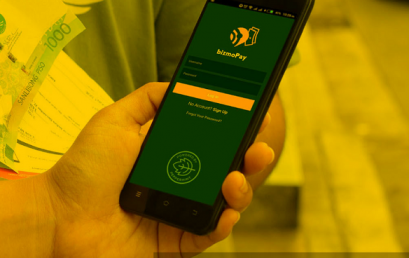

Peppermint gets key regulatory approval in the Philippines to offer bizmoPay loans

The financial lending service – branded bizmoPay – fully complements the commercialisation of Peppermint’s proprietary technology platform.

Cloud banking platform Mambu launches fully digital solution for SME lenders

Mambu, the market-leading SaaS cloud banking platform, has unveiled a fully digital solution for SME lenders that cuts costs and speeds time to market.

Fintech Tic:Toc strikes major funding deal with Bendigo and Adelaide Bank

Fintech platform and digital lender Tic:Toc has announced a seven year extension to its funding partnership with Bendigo and Adelaide Bank.

Moneytech calls for an extension to the Federal Government’s SMEG2 Loan Scheme

Moneytech Finance has called on the federal government to extend its SME Loan Recovery scheme referred to as SMEG2 in the face of extended lockdowns.

Ebury and Earlypay create FX and lending partnership to support Australian SMEs and brokers

Ebury and Earlypay are both committed to providing the Australian SME market with simple and accessible business financing and FX services.

Effi launches product search API to help brokers access data under new open banking system

Mortgage broking fintech Effi has today launched their new product search API to help brokers access data under new open banking system.

Broker channel is disrupting the personal loan space

Brokers are becoming the main players in the personal loan space, according to Daniel Foggo, CEO of one of the biggest fintech lenders in the sector.