Banjo Loans sees 250% increase in loans to healthcare sector

Banjo Loans has increased loans to the healthcare and social assistance sector by 250% in the past six months, fuelled partially by pharmacy fitouts for new high-tech shops.

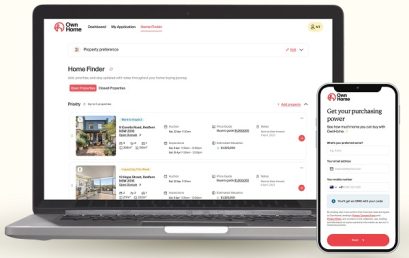

OwnHome launches Australia’s first 0% deposit home loan option to get more people onto the property ladder

CBA-backed OwnHome today launched the Deposit Boost Loan – an Australian first that will help aspiring buyers secure a bank loan with 0% deposit.

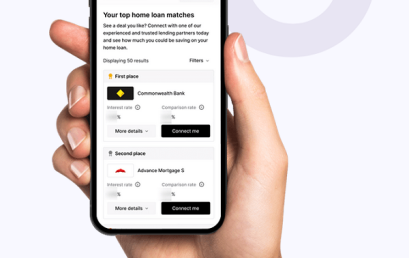

Joust partners with Lendela to expand financial empowerment

Home loan marketplace Joust have announced its partnership with Lendela, a prominent player in the personal loan industry.

IDVerse partners with online digital lending platform Nimo to fast-track home loans

IDVerse partners with Nimo, an award-winning online lending platform that delivers same-day, digitised lending from enquiry to settlement.

Introducing Australian FinTech’s newest Member – CFI Finance

As an independent finance company CFI Finance have the flexibility to learn more about their customers and to say yes more often.

Ethical-lending fintech Beforepay recognised in Wealth & Finance International FinTech Awards

ASX-listed Beforepay has been named Ethical Lender of the Year 2023 – Australia in the FinTech Awards hosted by Wealth & Finance International

Funding.com.au signs with Finsure

Funding.com.au and Finsure have partnered to make Funding’s bridging, business and building loan products available to Finsure’s brokers.

MONEYME becomes 3rd ASX-listed financial institution with B Corporation certification

Digital lender and non-bank challenger MONEYME has become the third ASX-listed finance provider in Australia to become a Certified B Corporation.