How the rich invest: Afterpay’s Nicholas Molnar makes a cool $200 million

The tearaway market success of Afterpay Touch Group has however supercharged the fortunes of its 28-year-old co-founder Nicholas Molnar. Afterpay is fast becoming the go-to payments platform for Millennial shoppers who want to own products immediately but pay for them in instalments. The instalment service is growing rapidly. It has more than 1.8 million customers and is growing at roughly 3300 new customers per day. There are now 14,000 retailers using the service; it will soon be available for buying Jetstar flights and in May announced it was transacting in the US after cutting a deal with retail powerhouse Urban Outfitters. The potential for growth in the US has been […]

Supply Chain Finance: What’s It All About?

Picture this. You run a business. It’s successful. You’re a supplier (subcontractor, etc.) to a large company (major retailer, major contractor, think big and corporate). You get an invitation to join their supply chain finance program. But what does that mean for you? And why is it being offered in the first place? It’s possible this is the first time you’ve ever heard of supply chain finance, and if it is you wouldn’t be alone. It’s also referred to as supplier finance, or as an early payments program, and essentially, it’s a financing program by a large corporation that lets the businesses it deals with in it’s supply chain access […]

Fintech Startup Trade Ledger expands UK operation. Appoints New CFO

Fintech startup Trade Ledger — which describes itself as the world’s first corporate open banking lending platform — has announced the opening of its European operation, headquartered in London, along with additional hires. Lisa Callaghan will move from the role of accountant to Chief Financial Officer at Trade Ledger’s Sydney office, after representing technology start-ups from inception through to early fundraising as a partner at Interactive Accounting. The UK operations will be headed up by a new Chief Innovation Officer with the company tapping some talent from Equifax UK. The expansion is designed to boost Trade Ledger’s international traction and product market fit, and should allow it to take advantage […]

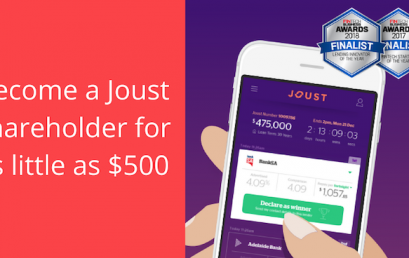

Adelaide fintech startup Joust seeking to raise $2m in Equity Crowd Funding

Adelaide fintech startup Joust is launching an equity crowdfunding campaign via OnMarket and is hoping to raise $2 million to rapidly scale the business. The Joust platform, launched in 2016, links borrowers with more than 20 lenders who compete against each other to offer the lowest interest rate via a reverse auction process. Using equity crowdfunding platform OnMarket, the company plans to spend a large portion of the money raised on advertising, with the remaining funds to go towards product development, potential entry into overseas markets and building out the Joust team. A minimum $700,000 is being sought as part of the capital raise, which allows retail investors to invest between $500 […]

Fintech business lenders sign code to lift transparency

Six fintech start-ups that lend to small business have signed a ”code of lending practice”, a move the small business ombudsman says will improve transparency and protect SMEs by requiring the online lenders to disclose standardised pricing and fairly resolve disputes. Prospa, which pulled an ASX float this month on concerns about its transparency, is a signatory to the code, along with Spotcap, Capify, GetCapital, Moula, OnDeck. They will be compliant by the end of the calendar year. The code will be enforced by an independent committee to be set up by the Australian Finance Industry Association. AFIA has helped write the code, alongside the Australian Small Business and Family […]

Fintechs tell Labor a credit report delay will entrench bank power

Labor’s push to delay a law requiring the major banks to put more customer data into credit reports will entrench the big four’s market dominance and keep the cost of personal loans unnecessarily high, five of the nation’s leading marketplace lenders have said. In a letter to shadow treasurer Chris Bowen, the CEOs of SocietyOne, RateSetter, MoneyPlace, Harmoney and WISR said a further delay to mandating big bank participation in the ‘comprehensive credit reporting’ (CCR) regime will “continue to entrench a fundamental competitive imbalance between the big four and other lenders”. The letter is a response to Mr Bowen’s move last week to call for a delay to CCR by […]

Put your money where your trust is

Why Nifty Personal Loans is the lender for you. In light of the recent fine laid down to the Commonwealth Bank of Australia for breaching anti-money laundering and counter terrorism laws, the credibility of Australian lenders has once again come under scrutiny. The massive $700 million settlement, the largest ever civil penalty in Australian corporate history, was agreed upon by CBA and the Australian Transaction Reports and Analysis Centre (AUSTRAC) earlier last week. It is said that CBA’s breach of anti-money laundering laws allowed large crime syndicates to launder funds through the bank’s ATM’s and Intelligent Deposit Machines (IDM’s). The bank and trusted lender failed to carry out appropriate assessment […]

Westpac ends Prospa deal as banks plan more unsecured SME lending

Westpac Banking Corp has ended its referral relationship with Prospa, a sign major banks are preparing to ramp up unsecured small business lending to try to regain some of the market that has been surrendered to start-ups. After Prospa indefinitely postponed its ASX listing last week amid questions on whether its loan contracts breached new laws, the online business lender faces more intense competition from big banks who are developing new products to lend more to small business without requiring residential property to be pledged as security. “We did not continue our contract with Prospa because we are working on developing our own products that will satisfy more of our […]