Top-heavy bank sector holds back FinTech potential

A top-heavy banking ecosystem coupled with an under resourced regulatory regime is holding back Australia’s FinTech potential, according to industry leaders

Neobank Volt, LAB3, and Microsoft partner to build “Volt 2.0”

Microsoft today announced a strategic partnership with neobank Volt to develop “Volt 2.0” – a next-generation Banking as a Service platform.

Connecting your bank for pay on-demand

Basiq has partnered with Cheq, a fintech aiming to put an end to the payday distress cycle by providing consumers with on-demand access to their wages.

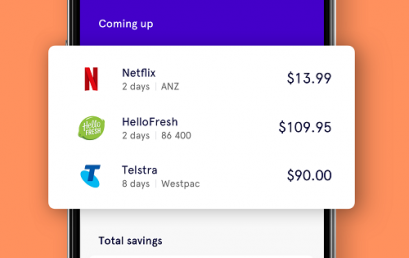

86 400 unveils Open Banking product

Australia’s first smartbank, 86 400, has today unveiled the first consumer-facing feature developed using Open Banking product data

Mx51 gears up for global growth

Australian fintech company Mx51 is in the process of inking a deal with a global bank as it gears up for global growth.

Aussie banks take on Afterpay, Zip Co in BNPL battle

As Australia grapples with the financial impacts of COVID-19, the big four banks are at a crossroads, being been challenged to evolve and keep pace.

86 400 wins Best in Class at Australia’s International Good Design Awards

Australia’s first smartbank, 86 400, has received the prestigious Good Design Award Best in Class accolade in the Digital Design Apps and Software category.

Mastercard launches testing environment for Central Banks and digital currencies

Mastercard has announced a proprietary virtual testing environment for central banks to evaluate Central Bank Digital Currencies (CBDCs) use cases.