Fingerprint payments to be ‘commonplace’ within a year: Visa

Shoppers will soon be able to take a scan of their fingerprint or face to authorise a credit card purchase, instead of entering a PIN, as part of a crackdown on payment fraud. With online card fraud rising quickly as stolen card details are used for website purchases, payments giant Visa is rolling out a suite of new changes aimed at stopping fraudsters. In a bid to counter fraud, it has issued new standards that will remove the need to enter a personal identification number (PIN) when making purchases in-person. It is also beefing up its systems for detecting fraudulent transactions made online. Instead of using a PIN for purchases […]

Australian RegTech partnerships crucial for banks moving forward, in light of the Banking Royal Commission

With the announcement of the Banking Royal Commission, Australia’s regulatory technology (RegTech) providers point to a lack of compliance and regulation among Australia’s Big 4 Banks. There continues to be a call for a parliamentary commission into unethical or unlawful conduct by the financial services industry in Australia. However, there is a growing and proactive movement for develop regulatory technology across the world, which will assist in detecting and preventing these issues, with Australia leading the way in this area. The Australian regulatory system is held in very high regard globally and much work is being done by both the Australian regulators and financial institutions to improve innovation and collaboration, […]

Commonwealth Bank to deliver ‘world-first’ issuance of a bond on the blockchain

The bank’s head of blockchain has revealed the Commonwealth Bank is currently implementing with a large world issuer in what will be a ‘world-first’ issuance of a bond on the blockchain that it hopes to bring to market in 2018. The Commonwealth Bank of Australia (CBA) is expecting to be the first to implement the issuance of a bond on the blockchain, and hopes to launch it into the market early next year with help from a “very large” world issuer. Although the details are limited, the bank’s head of blockchain Sophie Gilder told the GMIC Sydney conference on Tuesday that the launch will be the culmination of CBA investing […]

Banking gap widens as tech-savvy consumers look to new products

They’re called peer-to-peer lenders or fintech companies and they’re shaking up the world of consumer loans and bank deposits. Here’s why. The gap between what people pay for consumer loans and what they get from bank deposits is widening, prompting them to look to new financial technologies for better interest rates. Peer-to-peer lender RateSetter has examined big bank profit margins and found that while they are paying record low rates on deposits their lending rates for personal loans and credit cards continue to climb. “You can drive a bus through the spread between bank deposits and consumer lending rates,” said RateSetter CEO Dan Foggo. “Publicity stunts such as dropping fees […]

Australians are increasingly using their phone as a credit card: Deloitte

The pressure is on Australian banks to keep up with customer’s growing use of smartphone apps to pay for in-store and online purchases. A Deloitte survey has found the use of mobile payment solutions has grown 14 per cent over the past year, with over a quarter of respondents now using them. Mobile payment solutions include apps such as Apple Pay, Samsung Pay and Android Pay, which allow users to process payments for online or in-store purchases using the app, without having to punch in their credit card details every time. Most of these apps act as “mobile wallets”, allowing users to store their card details and authorise payments using […]

Turnbull’s banking royal commission welcomed by fintech

Malcolm Turnbull has announced plans to establish a royal commission into the banking sector, and one fintech is hopeful it will bring more competition and trust to financial services in Australia. The announcement comes following a letter from ANZ, Commonwealth Bank, Westpac and NAB to the Treasurer asking for an inquiry to restore public faith. Alternative finance and peer-to-peer lender MoneyPlace’s CEO Stuart Stoyan told Canstar a banking royal commission “has been a long time coming”. “It’s important to re-establish trust with banks and financial services more generally,” he said. “I’m hopeful it will allow us to review policies that enable fintech to provide great products and services to all […]

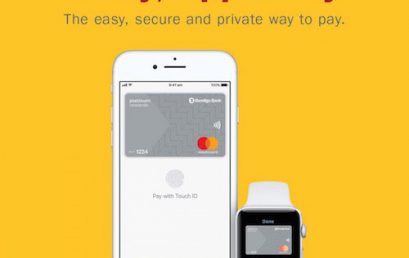

Bendigo Bank customers can now shop with Apple Pay

After battling with Apple earlier this year, Bendigo Bank has now partnered with all three major digital wallets. Bendigo Bank is the latest Australian institution to join the Apple Pay ranks. From today, Bendigo Bank Mastercard customers can use their iPhone, Apple Watch or iPad to make contactless payments. This means lighter wallets, faster transactions and even more secure payments. To link your Bendigo Bank credit or debit card with Apple Pay, you just need to open the Wallet app and tap the plus symbol in the upper-right corner. Then follow the prompts to enter your card’s security code to add your credit or debit card from your iTunes account. […]

ANZ tech chief heralds its Apple advantage in bank tech revolution

Australia and New Zealand Banking Group’s top technology executive has claimed its decision to move ahead of its big four rivals with Apple Pay has led to big advantages in both customer and skilled staff acquisition as it seeks to position itself as a bank that operates like a tech giant. Speaking with The Australian Financial Review after addressing a Trans Tasman Business Circle lunch event in Sydney on Friday, ANZ’s group technology executive Gerard Florian said he was surprised that no other of the big four banks had sacrificed a slice of payment revenue to sign on with Apple Pay, and that ANZ was delighted it took the plunge […]