Australia’s ‘first’ blockchain lender sets sights on mortgages

Australia’s “first” blockchain lender, which is set to launch next year, is offering a crowdsourced funding equity to brokers. Australian Mortgage Marketplace (AMM), co-founded by industry stalwarts Graham Andersen (CEO) and Kym Dalton (COO), has pledged to “overhaul” the Australian mortgage market with the “biggest change since the GFC” by funding prime loans on “Australia’s first mortgage securitisation blockchain”. According to the wholesale lender, which aims to be backed by major investors and industry super funds, its “Carbon” securitisation platform will leverage distributed ledger technology to deliver the benefits of increased transparency, security and automation. Its operating efficiencies will also reportedly present “pricing benefits” for Australian borrowers, enabling partner brokers to […]

ASX-listed Peppermint Innovation registers more than 5,000 Bizmoto agents in the Philippines

Peppermint Innovation Limited announces that to date more than 5,000 agents have signed up to its Bizmoto network in the Philippines. Having launched the Bizmoto agent network in late May followed by a preliminary digital marketing drive which started on August 23, the Philippines operations team had registered 5,000 Bizmoto agents as of the end of last week. The agents are now being on-boarded and trained in how to deliver the various Bizmoto services, including mobile banking, mobile eLoad, bill/product payment and money transfers. They also receive training on how to charge and recharge their electronic wallets, which they use to facilitate Bizmoto services. At present, Filipinos can use their […]

Huge Sibos event shows surging clout of banking and fintech

More than 7000 global bankers have flooded into the International Convention Centre in Sydney on Monday for an unprecedented opportunity to download the latest cutting-edge thinking about global finance over the next four days. And by the looks of hundreds of booths representing the world’s biggest banks in the vast exhibition hall – which are more like fully blown bank branches – it’s clear some serious business is being done here this week too. The world of global transaction banking used to be relatively boring, uninspiring even; after all, this is the plumbing of the financial system. But the sheer scale and topics on the agenda of this year’s Sibos […]

The Perth women making your life better with technology

While most of the world is still coming to grips with just what blockchain is there are two West Australian women who have poured everything they have into taming the digital beast to tackle real world problems and improve everyday life. Blockchain is the underlying technology behind cryptocurrencies like Bitcoin, but across the globe entrepreneurs to huge multinationals are exploring its use in other areas like financial services, energy and education. In its simplest form a blockchain is a digital transaction record that isn’t stored on any one computer. This decentralisation means once a transaction is recorded it cannot be tampered with, making the technology attractive to banks and finance […]

ANZ CEO Shayne Elliott says technology will kill the banking oligopoly

Rapid technological disruption will break apart the Australian banking oligopoly and overturn the universal banking model that has underpinned big bank profits for decades, the chief executive of ANZ Banking Group told thousands of global bankers on Monday. In order to thrive in an uncertain future, banks will need to partner more with start-ups and global tech giants and potentially sell financial products manufactured by outsiders, Shayne Elliott said. The ANZ boss said dealing with the fallout of the Hayne royal commission simultaneously with unprecedented technological change was “challenging”, although he remained optimistic that ANZ could cope with both. The four-day Sibos event in Sydney this week is being attended […]

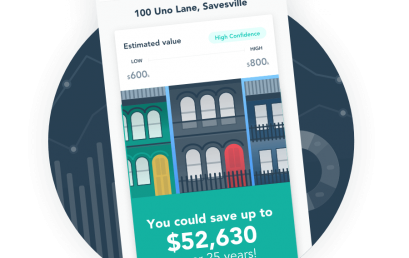

uno cracks the formula for 10-minute home loan recommendations

Online mortgage broker uno Home Loans has introduced technology that delivers refinancers a credit proposal for a cheaper home loan in the time it takes to drink a coffee. Watch the video here. The new refinancing pathway on uno’s platform digitises the process to combine a property valuation; ID verification; instant credit check; collection of current loan details; verification of income, expenses and liabilities; and assessment with credit policies from nine lenders. This expedited process – which would take days with a traditional broker – addresses a major barrier to more Australians refinancing and saving. uno Home Loans Founder and Chief Innovation Officer Vincent Turner said, “Many Australians know they […]

DriveWealth partners with Verrency to offer consumers access to a new savings and investing strategy

Digital brokerage solution provider DriveWealth has joined forces with Australian global payments innovator Verrency. The partnership will enable DriveWealth to deliver its ground-breaking fractional share investment platform to a new segment of consumers. As a result of the agreement between the two companies signed today at Money20/20 in Las Vegas, shoppers who have a debit or credit card will have the opportunity to seamlessly invest in companies from which they purchase goods and services. For example, if you buy shoes from the Nike store, you can elect to round up or put a percentage of the purchase price towards buying shares, or a fraction of a share, in the company. […]

Irish FinTech company PerfectCard confirms its sale to Australia’s EML for €6m

Irish FinTech company PerfectCard has been sold to Australian payment solutions provider EML Payments in a €6m (A$9.5m) deal. PerfectCard provides incentive and corporate expense solutions including PerfectIncentive and the recently-launched Pecan Expense. The acquisition will result in the expansion of PerfectCard in Ireland, with plans to increase the number of full-time employees over the next few years, the company said. Under the deal EML has acquired 75pc of PerfectCard, having received Central Bank approval for the transaction in the past two weeks. Commenting on the announcement, Nikki Evans, CEO of PerfectCard, described it as an important move for both companies. “It allows EML to self-issue regulated payment products across […]