Blackhawk welcomes new Managing Director of Commerce, Australia

Blackhawk Network announce today that George Lawson, will be joining Blackhawk Australia as Managing Director, Commerce Australia.

EML & Frollo unveil the future of money with EML Nuapay

EML Nuapay is a payment revolution with Frollo and gives clients the ability to choose between a no-code, low code and fully customisable API solution.

Payments company Novatti confirms booming growth with another record quarter

Novatti’s quarterly update highlights the company’s strong execution on its strategy to become a global payments company.

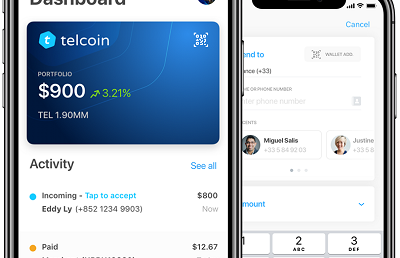

Telcoin set to start remittance operations in Australia

Telcoin says it will officially open its remittance service to Australia through its iOS and Android mobile applications.

Azupay delivers an Australian-first for real-time payments with Warrp

Warrp, a newly launched Australian online consumer-to-consumer marketplace, chose Azupay to facilitate all payments on the platform.

BGL achieves industry leading results for Customer Support

BGL Corporate Solutions announces industry leading results achieved by its customer support teams.

FinTechs want AEC data for digital ID checks

The government will consider whether to grant access to the electoral roll in order to assist FinTechs in conducting digital ID checks.

MoneyMe closes $15 million bond issue

The bond issue comes at a time of exceptional growth for MoneyMe, which will be further accelerated by the launch of the Autopay car finance product.