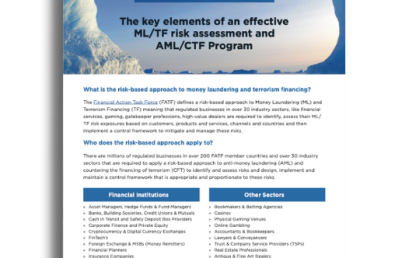

Is your business fully aware of its vulnerability to money laundering and terrorism financing risks?

As you know, money laundering and terrorism financing laws are risk-based. This means that regulated businesses like yours must conduct business-wide ML/TF risk assessments.

International fintechs Paysend and Currencycloud sign major global expansion deal

Currencycloud and Paysend have announced a major expansion to their longstanding partnership that will see Paysend expand its services around the world.

Raiz Invest finalises exit of Indonesian operations

ASX-listed Raiz Invest, a leading investment app, have announced that it has finalised the exit of its Indonesian Joint Venture operations.

At your service: how Australian financial institutions can elevate their customer experience in 2024

Banks and other financial services providers know the way customers are choosing to engage with them is evolving fast

Tyro to offer complimentary EFTPOS readers to charity and community organisations

Tyro is offering charity and community organisations complimentary EFTPOS readers to help them take payments, donations and fundraising with ease.

Easter egg or nest egg? Gifting gold to adult children this Easter

What if this Easter you could give your adult children something longer lasting than chocolate, and more valuable to their future?

EzzyBills AI webinar delivers knowledge and provokes curiosity

The recent EzzyBills AI webinar delved into the specifics of how EzzyBills has implemented an amazing new AI feature into its software.

Spenda Accounts Payable x Spenda Wallet: The faster and more secure way to pay invoices

Spenda, a leading B2B software and payment solution provider, has announced a significant upgrade to its Accounts Payable (AP) solution.