Apple Pay leads Digital Wallet usage

Usage of Apple Pay for contactless payments is set to nearly double in 2017, with significantly more users than both Google and Samsung’s digital wallets. Data from Juniper Research indicates Apple Pay will have 86 million contactless users by the end of this year, ahead of the 34 million users of Samsung Pay and 24 million users of Android Pay. Combined, the three digital wallets will surpass 100 million contactless users in the first half of 2017, before surging to over 150 million by the end of the year. Juniper noted that, while Apple will continue to dominate, growth is expected to continue for all three digital wallets, which increased […]

Westpac customers can now use Samsung Pay

Westpac has today announced their debit and credit card holders can now use Samsung Pay – a first move from the big bank outside their own app and payment technology. While they may have been fighting to collectively bargain with Apple for access to Apple Pay it seems Westpac were happy to jump on board Samsung’s digital wallet offering access to their customers and becoming the first major bank to support Samsung Pay. Alongside Citibank and AMEX, Westpac customers can add their debit and credit cards to access tap and go payments from their phone or Samsung smart watch. Richard Fink, Vice President, Mobile Division at Samsung Australia said: “We […]

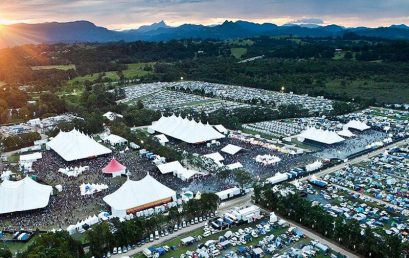

From hippie to hi-tech: Byron Bay Bluesfest ditches drink tickets for RFID microchip wristbands

WHAT will the hippies say? Drink tickets will make way for microchip technology at this year’s Byron Bay Bluesfest in a move set to divide the counterculture community of northern NSW. RFID (Radio Frequency Identification) wristbands will serve as ‘digital wallets’, replacing the traditional drink ticket system when the five-day annual Easter music festival opens on Thursday. Increasingly popular at overseas events, RFID technology uses radio waves to read and capture information stored in wristbands to simplify entry, reduce paper tickets and ticketing fraud, slash queues for drinks and ATM machines and minimise the need to carry large amounts of cash to events. The new Bluesfest RFID wristbands will give […]

TorFX Awarded Best Value International Money Transfers

MOZO, one of Australia’s most established and accredited financial comparison websites has just announced TorFX as its Experts Choice Award for International Money Transfers 2017. This is the second year running that MOZO have awarded the title to TorFX; great recognition for a company who believe offer their customers the best value when making international payments to and from Australia. TorFX provide individuals and businesses with international payments as a cost saving alternative to the banks, by providing their clients with more competitive exchange rates than the more traditional means. TorFX clients can transfer money online 24/7 from anywhere in the world using their computer, tablet or smartphone. […]

Moneysoft enters new partnership with Mortgage Choice

Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals. Mortgage Choice Financial Planning will offer the tool under the name of MoneyTrack as a part of their cash flow coaching service. Tania Milnes, general manager of Mortgage Choice Financial Planning, said the new tool will help its national network of advisers to enhance the affordable and transparent advice they provide to clients. “The introduction of MoneyTrack will provide a robust basis for the advice we currently provide to help manage their cash flow,” she said. “It gives clients an easy to understand tool […]

SelfWealth TRADING release mobile trading app

Australia’s only flat fee brokerage solution, SelfWealth TRADING give investors greater accessibility to trade the ASX with the launch of their Trading App. SelfWealth TRADING hit the market in late 2016 with a fixed fee no commission offering and since has grown their client base to approx. 8000 members. SelfWealth TRADING members can trade the ASX for just $9.50 per trade. The Trading app will allow SelfWealth members to buy and sell shares on the go, conduct stock research and monitor their investment portfolios in real-time. SelfWealth Managing Director, Andrew Ward commented that “The app is designed to give members greater visibility of their investments and to ensure they never […]

Perth fintech Peppermint Innovation provides payment services to the unbanked in the Philippines

There is much to debate about the growth of Australia’s startup ecosystem, but it is a truth almost universally (well, in Australia, at least) acknowledged that the local fintech sector is doing well, bolstered by government support and corporate involvement. While most startups look to develop sophisticated products and services to tackle problems across every niche imaginable in the sector for savvy local consumers and companies, Perth fintech Peppermint Innovation thought there were significant opportunities to be found with those entirely new to banking. Founded by brothers Chris and Anthony Kain, who grew up in the small town of Narrogin, the company is providing mobile remittance services to the unbanked […]

Fintech firm’s education offering to merge soft, practical skills

Online learning business knowITdigital has partnered with Monarch Institute to roll out a diploma and advanced diploma of financial planning for the 4000 subscribers to its wealthdigital tool, with content set to cover a broad spectrum from behavioural science to policy. The fintech firm’s offering will be designed as the first step in preparing planners or prospective planners for the new education standards, due to become mandatory from 2019. The firm also plans to replicate the model for the accounting profession eventually. Monarch Institute chief operating officer Nick Chapman says the courses will merge practical elements and soft skills with the more traditional, technical content you would expect from a […]