Ex Zurich Australia CEO heads up new insurtech startup, Evari

A major new start up in the insurance industry called Evari (www.evari.insure) has been announced in Australia, led by former CEO of Zurich Australia & NZ, Daniel Fogarty. Evari will provide a customer first, digital experience, that simplifies the purchase and management of business insurance and will launch in mid 2017. “At Evari we are using technology to create a great customer experience and solve challenges that SMEs face when buying their insurance”, Daniel said. “I know first-hand the challenges that incumbents have trying to get innovation into the insurance process, and I firmly believe there is a better way of servicing the needs of small businesses”. With co-founders from […]

Winners of the British Australian Fintech Forum Start-Up Competition announced

The Australian British Chamber of Commerce is delighted to announce the winners of seven supported places for the British Australian Fintech Forum to be held in London between the 19th and 21st of April 2017. The winners are (in no particular order): Chris King – Splend Edward Jones – Neu Capital Rob Lincolne – Paydock Doug Morris – Sharesight Charlotte Petris – Timelio Jack Stevens – Edstart Emma Weston – AgriDigital Andrew Chick, Chairman of the BAFF Committee said: “We received over 50 applications for our supported places. The Selection Committee was very impressed with the quality of submissions and deciding on the final seven was particularly difficult. We are […]

Midwinter adds Omnium to its Fintech Ecosystem

Midwinter has announced the completion of its integration between AdviceOS and Ominum’s OmniLife. This allows the real-time flow of insurance premium product data from OmniLife into the AdviceOS Fact Find, Client Portal and Statement of Advice generator. It also allows client data from AdviceOS to be pre-populated into OmniLife, ensuring a synchronised connection between the two solutions. Midwinter has been forthright in their philosophy regarding open architecture software, believing that advisers of today need software systems that can speak to each other. This allows for freedom of choice as well as eliminating the double entry of data across multiple systems. Stressing this point, Managing Director of Midwinter Julian Plummer said […]

Indonesian Australian Business Week review – FinTech opportunities over our back fence

by Joe McGuire, Global Head of Sales for Airwallex We wade through the Jakarta traffic amongst the sour looks and disdain from our fellow commuters. Disdain because we have a police escort. Out front, a police motorbike beeps and harangues cars to the left lane. “Make way for the delegates” he shouts in bahasa as he beeps and swerves at others trying to negotiate the famous Jakarta sprawl. I’m here for the Indonesian Australian Business Week (IABW). An Austrade event designed to forge connections between Aussie businesses and our closest neighbour. With nearly 260 million people and a forecast of nearly 6% GDP growth this year, Indonesia is […]

NRMA Business Insurance partners with Prospa to lend a hand to small business owners

With cash flow and financial responsibilities being two of the most common things keeping business owners awake at night, NRMA Business Insurance has entered into a pilot partnership with small business lender Prospa to offer customers a faster, simpler finance solution. Prospa is an online small business lender and one of the fastest growing technology businesses in the country. It offers small business owners the flexibility and ease of accessing business loans between $5,000 to $250,000 online, with approval within a day. Through the partnership, NRMA Business Insurance customers can now access Prospa’s lending services alongside other benefits offered by the insurer, such as free online tax and […]

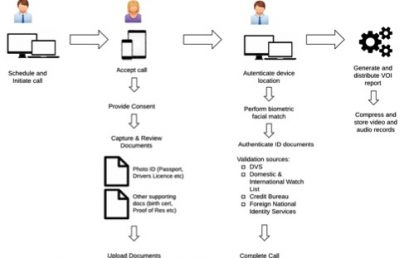

Regtech player e4 introduces Australia’s first-ever Virtual ID solution

South African regulation technology company e4 has arrived in Australia with the promise of enhanced corporate regulatory compliance and superior customer convenience, thanks to its introduction of Australia’s first real-time, ‘virtual’ alternative to face-to-face ID verification. e4’s new Virtual VOI (Verification of Identity) platform delivers Australian businesses the first ever digital opportunity to ensure compliance with global and local anti-money laundering and counterterrorism financing (AML/CTF) standards, increased customer and workforce convenience and a substantial saving against other ID verification services in operation across the country. Founded in 2000, the e4 Group has already become a dominant and trusted software and technology services provider to the banking, legal and […]

The Benzinga Global Fintech Awards – entries closing soon

The Benzinga Global Fintech Awards May 11, 2017 in New York, is the premier event in Fintech, celebrating financial innovation from around the world. The Benzinga Awards is a competition to showcase the companies with the most impressive technology, who are paving the future in financial services and capital markets! Applications are still open, so apply now before the March 17 deadline. At the event, you’ll get a first look at groundbreaking technology, innovative platforms, and the chance to network freely with top industry professionals. Over 550 FinTech CEOs, C-suite executives of financial institutions, VCs, press, and others attended the 2016 Benzinga Fintech Awards. 45 exclusive exhibitor spots on the show floor […]

Sydney Fintech Moroku signs global distribution deal with Misys

Misys is making gamification an integral part of its Misys FusionBanking Essence Digital platform to help banks educate the next generation on better money management. Integrating Moroku’s GameSystem directly into the Essence Digital architecture enables banks to inject some fun into personal financial management (PFM) and help consumers achieve their savings goals. “Digitalisation has completely changed the way that people interact and we believe the next generation will be more incentivised through gamification,” said Simon Paris, President at Misys. “Supporting better financial management and education in banking is a powerful tool that moves consumer experience beyond the transactional and opens the door to bring people of all age groups […]