Top-heavy bank sector holds back FinTech potential

A top-heavy banking ecosystem coupled with an under resourced regulatory regime is holding back Australia’s FinTech potential, according to industry leaders

Neobank delays loan rollout due to COVID-19

Due to the COVID-19 pandemic, Volt Bank is delaying the launch of its loan products to ensure its foray into lending is done “in a very prudent way”.

Australian neobanks face a sterner challenger than their UK equivalents did

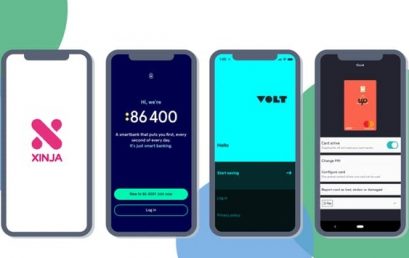

Australian neobanks such as 86 400, Up and Volt, are trying to make dents in an extremely consolidated banking market dominated by the four major incumbents.

Young savers flock to new wave of neobanks

Young savers are clambering aboard a new wave of Australian digital banks such as Up, Volt, Xinja and 86 400 in recent times.

What happens to my neobank account if I lose my phone?

Since your neobank account is only accessible through an app, what happens to your funds if you lose or misplace your phone?

Aussie fintech investment reaches $3 billion after 250% growth… but don’t celebrate just yet

Fintech investment in Australia is bucking the international trend. On a global scale, fintech investment actually dropped slightly.

Neobanks cast spotlight on big banks’ dubious practices

Australian neobanks have seen more than half a billion dollars in household deposits flow into their accounts since their launch.