2021 a tipping point; FinTech entering a new era, says Frost

As we enter the final quarter of 2021, and emerge from various lockdowns in NSW and Victoria, what is the state of fintech in Australia?

Adatree launches COVID Hotspot Alert – leveraging card purchases to alert you if you’ve visited a COVID Hotspot

COVID Hotspot Alert is a free service that sends users who made a card purchase at a hotspot venue or suburb a text message alerting them of their exposure.

Salter Brothers lead $6.5m capital raise for global digital payments platform Verrency

Melbourne-based fund manager Salter Brothers has led a capital raise of $6.5 million for global payments innovation platform Verrency.

Unhedged raises over $2.33m through Birchal crowdfunding

Unhedged’s Expression of Interest opened as a private offer to EOIs on 16 June and reached $1 million in six hours on the Birchal crowdfunding platform.

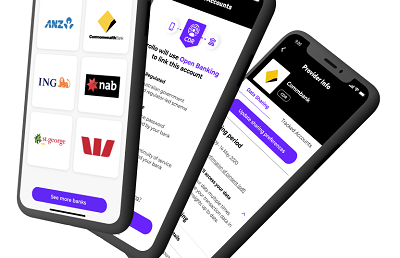

One year in and Open Banking provider Frollo has 12 live Data Holders

On 1 July 2021, one year after the Consumer Data Right kicked off in Australia, Frollo announces it has 12 Data Holders on their Open Banking platform.

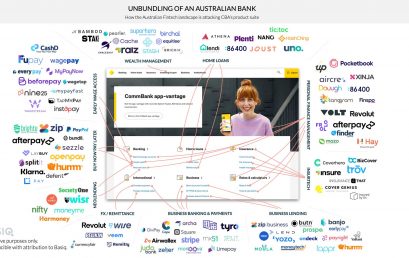

Unbundling The Big Four – What’s Next?

Australian Fintechs are unbundling the products and services offered by the Big Four and are moving toward ‘Rebundling’.

How Railsbank can provide new financial opportunities in Australia

London’s Railsbank has partnered with Australian neobank Volt, as Railsbank plans to improve and provide financial opportunities in the country.

FinTech-Bank collaboration is FinTech’s best bet, says Frost

There are many amazing fintech firms helping consumers make better use of their money, and amazing fintechs helping banks manage their customers better.