Sydney fintech Frollo scores $65,000 grant to take “Fitbit for finance” app to the next level, and reduce stress for Australians

Fintech startup Frollo has taken home a $65,000 grant from the MetLife Foundation, having been named best financial solution for low- to moderate-income Australians at MetLife’s Inclusion Plus competition for its gamified personal finance solution. Established in 2016, North Sydney-based Frollo is a personal finance app that uses gamified features to help users identify and change bad spending habits. The startup also licences its software to financial institutions and challenger banks, and founder and chief Gareth Gumbley tells StartupSmart it now has “tens of thousands” of users — a figure that is “edging towards the hundreds of thousands”. Gumbley has a background working in a consumer finance business and saw a […]

Entrust 2024 Predictions: Banking and Payments

“In Australia throughout 2023 there has been approximately 99,736 reports of phishing scams, amounting to $25,219,813 lost by victims to date.

Open Banking: Slowing down to speed up?

Australia’s leading Open Banking provider Frollo has published the fourth edition of its State of Open Banking report.

The 2023 Finnies have been run and won

The 2023 Finnies have been run and won with payments firm Zepto being named FinTech Organisation of the Year.

The Finnies 2023 finalists have been announced

The Finnies 2023 finalists have been announced and year’s awards drew over 300 entries from over 250 fintechs across 19 categories.

Open Banking in Australia is ready to take off and adoption will accelerate when the data is complete

Open Finance Advisors launches the first deep dive analysis and map of the Australian Open Banking Ecosystem.

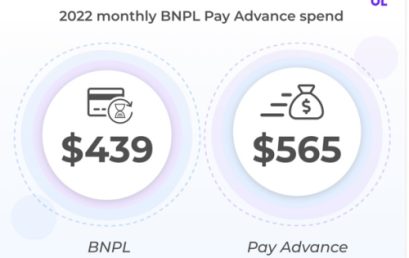

BNPL users are 43% more likely to use a ‘Pay Advance’ service

Frollo has published new research about Buy Now Pay Later (BNPL) and Pay Advance usage among 33,050 users of its money management app.