ANZ boss Shayne Elliott hot for start-up investments as it partners with Honcho

ANZ Banking Group has partnered with Sydney-based Honcho to fast-track customer small business registrations, as new boss Shayne Elliott drives the bank to work more closely with technology start-ups. ANZ’s managing director of corporate and commercial banking, Mark Hand, says ANZ is open to investing equity into fintech start-ups. It could establish a referral relationship with an online business lender, similar to the arrangement Westpac has with Prospa and Commonwealth Bank of Australia has with OnDeck. After Mr Elliott said he wanted his legacy to be defined by digital banking and criticised ANZ’s siloed approach to technological innovation in an interview with BOSS magazine earlier this month, Mr Hand said […]

P2P pioneers banking on bigger piece of market pie

As lending records are beaten on a daily basis, the nation’s biggest peer to peer (P2P) lenders are hopeful the relatively new industry will this year hit that much heralded mark: a tipping point. But Matt Symons, the chief of SocietyOne, isn’t getting “carried away” given the strong growth is off a low base. Nor has he wavered from his firm belief that the best outcome for his business — and the industry — is measured and disciplined expansion, as opposed to chasing rapid growth and writing bad loans that blow up. Indeed, three years after opening, Society One it yet to turn a profit, as ongoing investment, compliance and […]

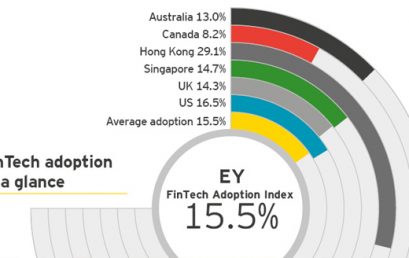

‘EY Fintech Adoption Index’ – out today

Ernst & Young have now released their ‘EY Fintech Adoption Index’ which outlines how quickly the market is taking up FinTech products. While we are a market leader in the adoption of credit card contactless payment technologies we are slow to take up FinTech products. As our market matures this is sure to change. Exploring a new financial services landscape Driven by innovative startups and major technology players, the booming FinTech industry is capturing traditional market share by offering customers easy-to-use and compelling products and services. We surveyed more than 10,000 digitally active people in Australia, Canada, Hong Kong, Singapore, the United Kingdom and the United States to better understand […]

Rise in data theft opens door for fintech

The ability to protect sensitive client information will be an integral driver for fintech companies, argues Midwinter managing director Julian Plummer. In a statement, the head of the financial planning software provider said companies that can secure high volumes of confidential data will become particularly important to the financial services industry in the coming years. “Ensuring the safety of all sensitive client data for our advisory clients has become a top priority for Midwinter, and we have taken extreme actions to ensure that information is managed and stored securely, so as to continue Midwinter’s clean slate of zero security breaches.” Zirilio executive managing director Tom Dole said he has seen […]

Innovation – NSW innovation minister says he will deliver three things the startup community is pleading for

He says one of the flagship policies of the state government last year was the establishment of a “world first” government data analytics centre facilitating data sharing between government agencies and allowing for the analysis of the effectiveness of policies. Dominello says the better use of public data can also assist with one of the booming startup sectors in the state: fintech. With Stone & Chalk and the Tyro co-working space, Sydney is leading the way with fintech startups, and Dominello wants it to stay that way. “We’re already the centre in south-easy Asia for banking and finance, so the fintech sector in particular is very, very strong,” he says. […]

What can we learn from fintech disruptors?

On Tuesday Prime Minister Malcolm Turnbull, declared: “there has never been a more exciting time to be in fintech,” – but in truth, there has never been a more exciting time to be in any kind of innovation. We can’t deny that technological innovation came late to financial services but it’s here now and it’s booming. Fintech has become a multi-billion dollar consumer driven industry globally and we’re on the cusp of something great here. As we grow as an industry, we’re making mistakes and learning from them – after all, that’s what innovation is all about! Thankfully, there is much to be gained from this learning process, not just […]

Big four banks disrupt Apple’s mobile payments expansion

Apple is struggling to persuade the big four banks to sign up for its Apple Pay mobile payment system, people familiar with the matter say, as the technology giant works from an unfamiliar negotiating position: weakness, not strength. Apple rolled out the service in Australia last month with support for payment cards issued directly by American Express. The move is part of the iPhone supplier’s global drive to extend its mobile consumer electronics prowess into financial services, with a China launch expected soon. But the firm has yet to strike a deal with any of the big four – ANZ, National Australia Bank, Commonwealth Bank and Westpac. That sets it […]

Listed fintech business to acquire Chant West

Independent Xplan customising provider Enzumo is set to acquire research house Chant West. Today’s News Acorns Grow Australia readies for soft launch ClearView enhances WealthSolutions wrap LIF to ‘devastate’ IFA numbers, O’Dwyer told Father and son duo join Fortnum RBA leaves cash rate on holdIn an announcement to the ASX yesterday, the listed fintech and e-learning service provider said it has entered into a conditional share purchase deed to buy Chant West for $9.5 million, including $6.98 million in cash and $2.52 million in shares at $0.28 per share. The deal is still subject to Enzumo shareholders’ approval. “Chant West’s research-driven services in the superannuation and pension markets, combined with […]