Finastra launches Open Banking Readiness Index in Asia Pacific

Finastra today launched its Open Banking Readiness Index, providing for the first time a framework for banks in the Asia-Pacific region to assess their capabilities and benchmark readiness against peers in the race towards Open Banking. Unveiled during Hong Kong Fintech Week, the research reveals that 84% of the top 146 banks in Asia Pacific are considering collaborating with external partners to enhance their Open Banking capabilities between 2018 and 2020. Developed in partnership with IDC Financial Insights, the Finastra Open Banking Readiness Index measures banks across five dimensions – Adoption of APIs, Fintech/Third-Party Ecosystem, State of Data-based Transformation, Data Monetization, and State of Innovation. It is based on interviews […]

Fintech revenue growth surges: EY census

Local fintech start-ups are confident revenue growth will continue on the back of the banking royal commission and a majority are planning to expand overseas as more funding is pumped into the sector, although a mostly optimistic outlook is tempered by fears of a skills shortage. Access to developer talent is a concern to almost half of the nation’s fintechs, who also want better access to the government’s research and development (R&D) tax incentives to drive growth. The results are in the annual EY Fintech Australia Census 2018, generated from an online survey of 151 start-ups, which was released on Monday at FinTech Australia’s Intersekt festival attended by 500 people in […]

IRESS launches its next-generation client portal to meet core client servicing needs

Financial technology business IRESS today announces the launch of its next-generation client portal with a clear focus on engagement. The new client portal, available now through IRESS’ market-leading financial software solution XPLAN, provides a contemporary, simple to use, front-end solution for businesses to engage their clients in a range of services digitally. IRESS product executive, Emily Chen said, “Today’s financial services businesses, including advice businesses, need to deliver a professional and personalised digital experience to their clients, offering an accurate perspective of their investments and financial life. Our new client portal provides a secure and straight-forward way for clients and financial professionals to engage and communicate with each other 24/7 […]

ASX-listed Peppermint Innovation registers more than 5,000 Bizmoto agents in the Philippines

Peppermint Innovation Limited announces that to date more than 5,000 agents have signed up to its Bizmoto network in the Philippines. Having launched the Bizmoto agent network in late May followed by a preliminary digital marketing drive which started on August 23, the Philippines operations team had registered 5,000 Bizmoto agents as of the end of last week. The agents are now being on-boarded and trained in how to deliver the various Bizmoto services, including mobile banking, mobile eLoad, bill/product payment and money transfers. They also receive training on how to charge and recharge their electronic wallets, which they use to facilitate Bizmoto services. At present, Filipinos can use their […]

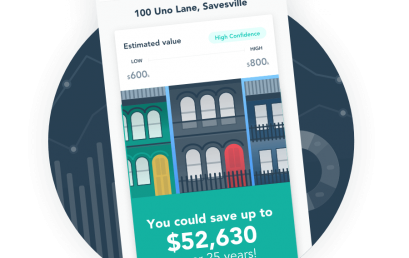

uno cracks the formula for 10-minute home loan recommendations

Online mortgage broker uno Home Loans has introduced technology that delivers refinancers a credit proposal for a cheaper home loan in the time it takes to drink a coffee. Watch the video here. The new refinancing pathway on uno’s platform digitises the process to combine a property valuation; ID verification; instant credit check; collection of current loan details; verification of income, expenses and liabilities; and assessment with credit policies from nine lenders. This expedited process – which would take days with a traditional broker – addresses a major barrier to more Australians refinancing and saving. uno Home Loans Founder and Chief Innovation Officer Vincent Turner said, “Many Australians know they […]

Lendi announces co-major sponsorship of the West Coast Eagles

Online home loan platform Lendi, has announced a new partnership as co-major sponsor of 2018 AFL premiership winner, the West Coast Eagles Football Club.

Verrency accelerates global expansion as the first FinTech to be selected into Plug and Play Fintech programs in three different countries

Verrency have announced expansion into Germany and another selection into Plug and Play’s prestigious Fintech Program. Verrency has been selected for Plug and Play’s accelerator programs in the Silicon Valley, Singapore and now in Frankfurt, Germany as the company extends its global reach in the FinTech market. Thousands of start-up companies apply to Plug and Play’s accelerator programs each year before being thoroughly reviewed by Plug and Play executives and their corporate Financial Institution partners. Only a handful get the opportunity to participate in the accelerator. Verrency has passed this test three times in three different countries. “It is wonderful to see Verrency thrive and it’s nice to have a […]

Identitii lists on ASX

Identitii Limited (ASX: ID8), an Australian FinTech enabling the secure overlay of transaction level detail on top of financial messages using a private blockchain, commenced trading on the ASX today at 11.00am AEDT. The listing follows a fully underwritten $11 million raising at $0.75 per share. 14,666,666 shares were issued for an undiluted market capitalisation at listing of $40 million. The Company is also pleased to announce the appointment of Clare Rhodes as Chief Marketing Officer and Mark Garvie as Chief Commercial Officer. Funds raised from the IPO will go towards further development and commercialisation of Identitii’s platform, already in use at a global bank, as well as to appointing […]