Why parents should start teaching their kids about money at an early age

How did you learn about money when you were a kid? Maybe your parents handed you a few dollars to swing by the grocery store for milk. After getting through the checkout line and carefully counting out the change, perhaps you stuffed the rest back into your pocket and headed back home. Today, teaching kids how to manage money is different. As technology around payments and money management has evolved, transactions are often no longer tangible. Cash is becoming less common and learning to become financially savvy is beginning to take a much different shape than in the past. From cash to V-bucks and in-app purchases This emergence of financial […]

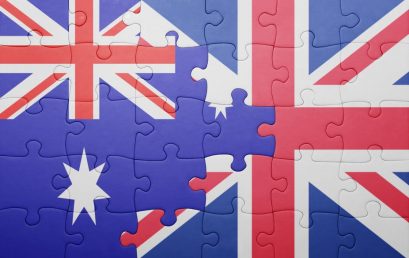

British fintech players circling Aussie market ahead, Xero says

Savvy British fintech players could sweep into the Australian market en masse this year if the open banking regime kicks off in July, jostling with local start-ups and potentially kicking off a round of joint ventures or mergers and acquisitions. That’s the scenario painted by Ben Styles, general manager of financial services at ASX-listed Xero, who has been central to the Kiwi accounting software company’s engagement with open banking regimes in Britain and Australia. Open banking hit Britain’s financial services sector in January last year, giving the vibrant fintech scene there an 18-month head start on the similar regime set to launch in Australia on July 1, assuming the election […]

TabSquare extends Zingrill’s custom POS and lifts average check value by 12%

Today’s consumers are extremely hard to please. In our instant, technology-driven world, we have high expectations that our demands will be met with a minimum of delay. In fact, a retail survey has reported that if you keep customers waiting more than 10 minutes, 48% of them will assume your business is poorly run and the other 52% will vote with their feet and take their business elsewhere. The food and beverage industry, in particular, is a victim of our impatience. How often have you walked into a quick service restaurant (QSR) and turned around and headed right back out when you’ve seen a long queue? Encouragingly though, 87% of […]

Use apps to target young investors: GlobalData

Utilizing technology to provide simple, easy-to-use, and accessible apps is paramount to appeal to young investors, according to data and analytics company GlobalData. GlobalData’s ‘2018 Mass Affluent Investors Survey’ found that 53.3 per cent of mass affluent investors between the ages of 18–34 agree they are easily flustered when things are complicated. The company sees this as proof that products should be kept simple in order to reach the young mass affluent population and encourage them to begin investing. “It is important to remember that while these apps may seem easy to use to the well-informed, tech-savvy crowd, it is just as important to ensure the same is true for […]

Five ways to better manage cashflow for your business

Did you know, according to the Australian Securities and Investment Commission (ASIC), 46% of all company failures occurred due to inadequate cash flow in 2015/16? Cash flow is vital to a business, and management should be priority number 1. So how can you better manage cash flow in a business, whether you sell products, provide services, or do a bit of both? Here are five ways to better manage cash flow in your business 1. Look at your balance sheets and make a projection In business, like in sport, you need to keep score. Keeping score tells you whether you’re winning or losing. Balance sheets and profit and loss statements […]

Why to accept Bitcoin as a payment method

By Josh Lehman, Co-Founder of Digital Surge It has been more than a decade since Satoshi Nakamoto published the original Bitcoin whitepaper and single-handedly disrupted our financial landscape, changing the way we send and receive money. Today, Bitcoin is no longer a niche interest of a handful of early adopters but a legitimate payment method that’s accepted by some of the largest companies in the world, including Overstock, Microsoft, Namecheap, ExpressVPN, Shopify, and Newegg, just to name a few. Even though Bitcoin and the entire cryptocurrency space may seem confusing and difficult to get into, the fact is that you don’t need to be an expert to start accepting Bitcoin […]

Australian small cap investors should turn focus to tech

Australian small cap investors should turn their focus to the increased use of technology across the financial services sector, and the investment opportunity it presents, according to DNR Capital. DNR Capital’s Australian Emerging Companies fund portfolio manager, Sam Twidale, said traditional financial services companies in Australia had long benefited from favourable regulation, limited competition and captive customers, but as change sweeps the industry, investors could be gaining exposure to new opportunities. “We are witnessing this change now as new business models emerge adopting the latest technologies, with today’s tech-savvy customers receptive to change,” he said. “In the Australian small cap sector investors can gain exposure to these niche opportunities, which […]

Big four banks consider creating their own digital brands

Each of the big four banks have considered launching new digital bank brands to attract new, young, digital-savvy customers. Apart from National Australia Bank’s UBank, the plans have been non-starters, getting lost among layers of bureaucracy, management changes and restrictions on new investment. But the pending launch of Volt Bank, which on Tuesday received an unrestricted banking licence from the prudential regulator, and with Up already in the market, the majors might be forced to reconsider whether creating entirely new standalone digital brands, or partnering with emerging players in the emerging “neobank” space, is needed to stay on the front foot in the fast-moving world of digital banking. NAB is […]