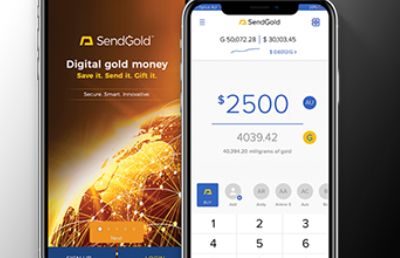

SendGold announces crowdfund via Birchal

SendGold has recently launched their anticipated investment EOI on the Australian crowdfund platform Birchal.

Open Banking could be the boost Australia’s challenger banks need

A new report from Pegasystems suggests Open Banking in particular could be a breakout moment for Australia’s growing cohort of neobanks and fintechs.

In 2019, Boomers boast the biggest uptake of crypto trading

New data from cryptocurrency exchange Independent Reserve has revealed rising levels of Baby Boomer and Generation X interest in crypto trading.

Can Australia’s Fintech companies take advantage of fair winds from Asia?

Fintech companies have emerged victorious in terms of providing innovation, encouraging employment and contributing largely to the GDP.

How to make Fintech attractive to Millennials

With millennials making up roughly a quarter of the world’s population, it’s not surprising that they’re shaking up traditional industries.

Teach your kids financial literacy with the ZAAP digital wallet

Pocket money takes on all new shape with the introduction of ZAAP which can teach the young digital savvy generation how to manage their money.

The FinTech Revolution – a challenge or opportunity?

The FinTech Revolution: a challenge or opportunity? Wednesday 3 July, 2019. Level 1, AGSE Building, Swinburne University of Technology, Hawthorn VIC

Niche areas that fintech is yet to exploit

No longer can it be argued that fintech is niche. Its impact has been global, changing the way individuals and businesses conduct their finances.