Mutuals are leading the way in Open Banking

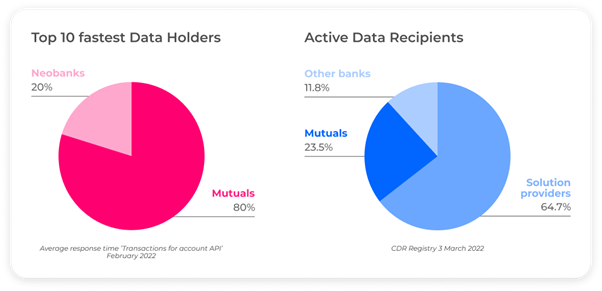

Frollo, the leading provider for Open Banking in Australia, has published their February 2022 report on Open Banking API performance, comparing the speed and reliability of Data Holder APIs. The report shows that when providing transactional data, 8 out of the 10 fastest Data Holder brands are mutuals. Though, the fastest Data Holder is not a mutual: Neobank 86:400 was fastest in February, just as they were the previous 5 months.

Mutuals aren’t just leading the way as Data Holders, some of them are establishing themselves as first movers in the use of Open Banking data too. In February three customer-owned banks became ‘Active’ on the CDR Registry as Data Recipients. P&N Bank, bcu and Beyond Bank all activated their connections using the Frollo Open Banking platform, as one of the final steps before launching their Open Banking powered financial wellbeing apps.

Tonina Iannicelli (Senior Manager, Digital, Beyond Bank) knows how critical it is to leverage technology for the benefit of their customers. “Open Banking provides us the opportunity to work for and with our customers by doing the heavy lifting on behalf of our customers, collecting their financial data from various institutions to help manage their finances – all in one place.

This is just the start, and we are excited to see how else we can work with our customers to get them decisions quicker, offer services that they value, and continue to nurture our relationship with them”.

P&N Group General Manager Technology Transformation, Erik Fenna, said unlike the listed banks, customer-owned banks such as the Group’s retail brands P&N Bank and bcu have a laser focus on customers rather than third-party shareholders, meaning the customer is at the heart of everything they do.

“We are focused on making banking easier for our customers by putting more control of their overall financial wellbeing and day to day banking in their hands through Open Banking,” Fenna said.

“By offering customer-centric technology that solves key financial pain points, such as money management and the home loan application process, not only will we make it easy to bank with us, importantly we will also make it easy for our customers to get ahead.”

Simon Docherty (Chief Customer Officer, Frollo) isn’t surprised to see mutuals leading the way. He explains, “Open Banking offers the biggest opportunity for customer centric businesses, as it can unlock better customer experiences, as well as more personalised products and services.

“Their focus on delivering value for customers has made Open Banking the perfect tool for mutuals to deliver on their promise, by providing financial wellbeing tools, improved access to credit and better deals on their finances.

We’re excited to help those early adopters in the mutual bank sector use Open Banking to deliver better customer outcomes.”