Digital disruptor True Savings launches into the Australian mortgage market with a next-generation broking platform

At a time when Australian families are under increasing pressure, start-up mortgage disruptor True Savings has launched its innovative digital platform that promises homeowners greater transparency and control of their mortgage.

Supporting the launch, the platform has released the inaugural True Savings Index for Home Loans. This report surveyed 52,000 households across Australia against the best rates available in the market. The sobering finding is that Australians pay $3.6 billion more than necessary in interest each year.

Founded by Pete Steel, former Chief Digital Officer of the Commonwealth Bank, the platform is committed to changing the dynamics of home loans and returning billions charged in excess interest, back to Australian families.

Pete Steel said, “We’re committed to disrupting overpriced home loans. It’s staggering to think that $3.6 billion is being wasted on excess interest. Now more than ever, we want to put this money back into the pockets of Australians that need it most. Your bank could be charging you an uncompetitive rate as soon as six months into the loan, and its even worse for loans over two years old. If you have not checked your current rate this year, you are almost certainly paying too much.”

The True Savings Index for Home Loans showed that, while many households are paying significantly more than the market rate, certain cities and suburbs across the country are especially bearing the cost of not reviewing their home loans regularly.

Incredibly, Sydney households are paying on average over $9,000 excess interest each year, and Melbourne over $7,000 each year.

In the Sydney postcode of Lane Cove (2066), for example, households collectively could be paying more than $23.8 million more in interest each year than they need to. The typical mortgage rate there is more than 1% above the market rate. In the Melbourne suburb of Cranbourne owners could be an average of $7,000 a year better off with their interest rates.

The top ten Australian postcodes paying more in interest than they needed to were:

- Mosman (2088) NSW

- Cranbourne (3977) VIC

- Lane Cove (2066) NSW

- Warrawee (2074) NSW

- Balgowlah (2093) NSW

- Beaumount Hills (2155) NSW

- Dover Heights (2030) NSW

- Hornsby (2077) NSW

- Glen Iris (3146) VIC

- Castle Hill (2068) NSW

Difficult mortgage products, confusing pricing and archaic processes, combined with lack of time means many customers tend to set-and-forget their home loan.

This allows banks to gradually increase the interest rate and margins for loyal customers. True Savings have launched with the commitment of addressing these problems and making it simple and easy for customers to save.

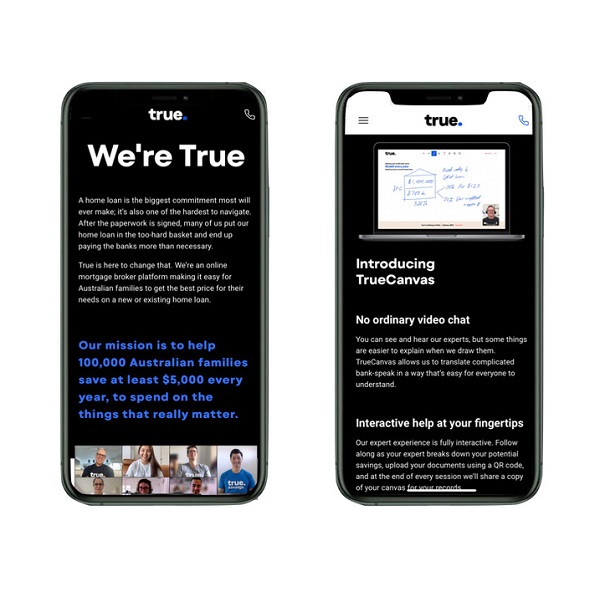

A standout feature of the True Savings platform is True Canvas, a genuine global first innovation. True Canvas lets customers get expert help over a collaborative video experience in a browser. In lockdowns and times of uncertainty, it provides convenience, with a personal touch.

The shared Canvas can be worked on by both the customer and expert, and is visually engaging with drawing tools and smart data widgets. The final picture is sent to the customer after the session to capture the conversation and saving opportunities.

“We did a lot of research with customers, and quickly realised that a pure digital mortgage experience would only hit the mark for a limited number of people.

Home loans are incredibly important decisions, and most customers want to talk to an expert in Australia to get the clarity and confidence they need to act. With True Canvas, we’re delivering a game changing digital and expert experience which puts customers in control, which they can access from the comfort of their home after the kids have been fed dinner,” Steel commented.

The platform also has an easy, quick home loan check tool that allows customers to test the price of their existing or new home loan. Called the True Check, it’s a simplified digital experience powered by a database of market rates – scanned daily across banks and alternate lenders and it is a process that is transparent and takes less than a minute.

The third feature of the True Savings platform is a data engine to simplify the home loan process for customers, and alert them in the future to further potential savings.

Using data to make the whole process easier for customers, True Savings also monitors the customer’s interest rate against the evolving mortgage market and alerts them in the future when they can potentially save money again.

True Savings is not owned by a bank and it’s not biased by advertising. The True Savings platform helps its customers renegotiate their current lender, refinance to a better deal, or get a new loan. This independence gives True Savings the opportunity to genuinely put customers first and so far, the platform has saved customers on average over $5,000 each year.

Steel added, “It is our mission to save money for Australians, who need it now more than ever. It’s great for the customer and good for our team to know families can spend money on things that really matter to them. The team are passionate about driving sustainable change and better customer outcomes in the home loan market.”

Based in Sydney, the True Savings team has deep digital, technology, design and home loan expertise.