Is Ripple too far ahead of its time?

As Swift and Ripple vie for the future of cross-border payments, an article published in American Banker has shed some light onto the obstacles facing both brands. At the same time, Swift has taken a step towards blockchain by linking its payments standard – GPI, or Global Payments Innovation – to R3’s Corda blockchain. It’s likely to be a winner-takes-all market because getting everyone onto the same network is crucial for getting the most out of the technology. As such, now might be a pivotal time for Ripple. The uptake numbers are sitting in Swift GPI’s favour though. Swift says more than 450 banks, which handle over 80% of international […]

CBA plugs 500,000 customers into Apple Pay in just two weeks

The Commonwealth Bank of Australia’s backflip on its longstanding Apple Pay boycott has paid off in spades, with more than half a million people flocking to the new payment service just two weeks after it was made publicly available to customers. The stampede of iPhone users is so big it has boosted the CBA’s total number of mobile banking by half, propelling the number from 1 million Android users to a total of 1.5 million total mobile numbers. The fresh numbers were revealed to investment analysts this week by CBA chief executive Matt Comyn, who credited the bank’s customer engagement platform for the delivering the result, before outlining how robust […]

Neo-lender Wisr sees increase in banking defectors amid Banking Royal Commission

Neo-lender Wisr (ASX:WZR) has launched a bold new campaign targeting disillusioned customers of big banks, following the Hayne Royal Commission handing down its findings into consumer lending practices. The ‘Australia’s Getting Wisr’ campaign taps into the prevailing sense of unfairness that Australians feel towards the big banks and how customers can make smarter choices when seeking personal loans. The campaign in the coming months will showcase the company’s personal loan, financial wellness programs and new smartphone application. It is the first brand campaign undertaken by Wisr since launching the brand in March 2018 and will appear nationally on television and online from this week. Earlier this week the Hayne Royal […]

Modern myki miracle: Android users give thumbs up to mobile payment trial

It has all the makings of a public transport miracle: a rollout of new myki technology that isn’t plagued by huge problems. At least not yet. Commuters taking part in a smartphone myki payment trial have given the beta test a cautious thumbs up, heaping praise on the convenience of topping up remotely and the system’s decent touch-on speed. Android users started using their mobile phones to pay for fares on Victoria’s trains, buses and trams after Public Transport Victoria invited 4000 people to take part in the test-run last month. There is still work to be done to ensure everyone can benefit: iPhone users remain locked out of the […]

Australian fintech leaders and startup founders react to the Hayne royal commission final report

After nearly 70 days of hearings, pouring through more than 10,000 public submissions the banking royal commission’s final report has been released. In it, Commissioner Hayne explains that one of the “complicating” factors is the impact of technological developments on the financial advice industry. Hayne writes: “Many in the industry have recognised that technology is likely to play an important role in the future of financial advice, but there is not yet a clear picture of what that role might be. Any recommendation directed to altering the current structure of the industry would need to grapple with the fact that the industry itself will very probably look very different in […]

The finalists of the 2019 Fintech Business Awards have been announced

The finalists of the 2019 Fintech Business Awards have been announced. Congratulations and good luck to all the finalists – both individuals and companies.

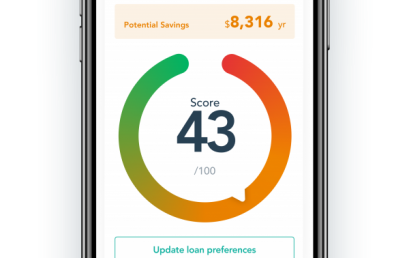

Know whether your bank is giving you a good home loan deal with uno’s loanScore

Australian fintech uno Home Loans is empowering customers to take back control with the launch of loanScore.

Bank sector transformation will come with open banking, competition: Xinja

Australian neobank Xinja said transformation of the financial services sector, described by Royal Commissioner Kenneth Hayne as often driven by greed, will only happen when consumers have clear choice, and can move easily and quickly between banks and other providers within the banking sector. The final report from the financial services Royal Commission paints a damning picture of the culture that drives Australia’s banks, with Commissioner Hayne imploring those who run Australia’s biggest and most profitable financial institutions to ‘obey the law’, ‘act fairly’ and offer services that are ‘fit for purpose’. “The reality is, the reason we’ve reached this low is that the sector has been controlled by a […]