Fintech DataMesh signs up private retail giant Peregrine

DataMesh Group has secured its first major contract, signing up Adelaide’s Peregrine Corporation to service the point-of-sale needs of its retail operations

How banks can work with Bitcoin’s original design

It’s time for banks begin embracing new business opportunities being created by the original design living now as Bitcoin SV (BSV).

Australian FinTech company profile #100 – Automic Group

Automic Group is the only company in Australia that offers integrated technology solutions combined with Share Registry, Legal, Company Secretarial services

Raiz backs Parliamentary inquiry rejecting calls to ban screen-scraping

Raiz Invest has welcomed the findings of a parliamentary committee that has rejected calls for an outright ban on screen-scraping.

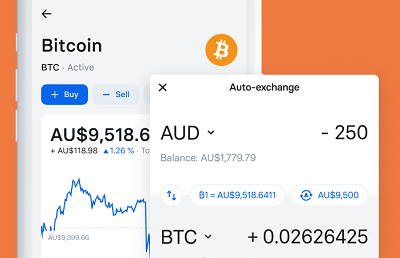

Revolut launches Australian cryptocurrency exchange

The Australian cryptocurrency exchange process allows Revlout customers to convert Australian Dollars – or 26 other currencies – into crypto via the app.

Zip welcomes fintech committee’s interim report

Zip Co Limited welcomes the release today of the interim report of the Senate Select Committee on Financial Technology and Regulatory Technology.

Plenti to list on the ASX after increasing IPO

The IPO is being jointly marketed by lead managers Bell Potter and Wilsons with Plenti slated to begin trading on 23 September 2020.