Growth, diversification, consolidation: AltFi Summit 2018 leaders offer their predictions

Fintech leaders from across the globe are converging for the AltFi Australasia Summit in April, to discuss the most urgent issues and trends impacting growth, diversification, and consolidation in the global alternative finance industry in 2018. Keynotes, panellists and sponsors will include alternative lending firms, digital banks, industry influencers and regulatory representatives, such as OnDeck, KPMG, Ratesetter, NowFinance, Equifax, Macquarie Capital, NAB, Moula, MoneyPlace, Credible, BGA Digital, Moneycatcha, Creditease, Othera, Liberty Home Loans, uno Home Loans, and FinTech Australia. It will be the third year the Summit has run in Sydney, amassing each yeah an ever-larger following of loyal attendees. Event owner, Glenn Hodgeman, believes momentum has built so strongly […]

How crypto currently looks in Australia

Australian crypto investors are like any others: long-term investors, short-term traders, and true believers who want currency beyond control of central banks. WHY ARE AUSTRALIANS BUYING CRYPTOCURRENCIES? Some are long-term investors, others are short-term traders, and some are true believers who want currency to be beyond the control of governments and central banks. All are hoping the value of Bitcoin (or their chosen asset) will appreciate over time as they become more readily accepted. WHY DO AUSTRALIANS NEED USE AUSTRALIAN EXCHANGES? Most people buy their first Bitcoin, Ethereum or other cryptocurrency using their day-to-day currency. If you hold Australian dollars and want to buy your first cryptocurrency, you need to […]

BDO implements Expensify internally to improve its receipt and expense management Process

After implementing Expensify for BDO clients as an ExpensifyApproved! Partner, the top 10 Australian accounting firm now adopts Expensify for its employees. Expensify, the most widely used expense software in the world, has been selected by BDO Australia to streamline its internal receipt tracking and expense management workflow. BDO moved away from two separate receipt tracking and expense approval systems, Receipt Bank and ApprovalMax, to centralise their entire process with Expensify. Company-wide rollout began earlier this month in BDO’s Adelaide office with 110 employees, and plans are under way to expand to BDO offices throughout the country. “As a partner in the ExpensifyApproved! Program, we’ve set up enough clients on […]

Digital mortgages offer great promise, says KPMG’s Pollari

There’s a tech for everything these days: MedTech, EdTech, FoodTech – you name it. Which may make fintech sound like just another portmanteau. But what makes fintech different from the other “-techs” – besides the fact it deals in money – is just how varied it is. According to a map put out by KPMG, there are more than 11 different types of fintech companies. These include: regtech, for regulation; insurtech, for insurance; wealthtech, for asset management – and many more. This wide definition – as well as a lot of optimism and entrepreneurial energy – has meant there are now around 600 Aussie companies that fall within the fintech […]

The Global Money Transfer Industry: A Case For Collaboration

Evolving with disruption The money transfer industry globally has entered a period of significant change, spearheaded by the evolution of mobile technology and growing demand for digital tools that help us manage our money faster and smarter. Digital disruptors such as peer-to-peer lending services, mobile apps and blockchain have shifted the market, offering borderless accounts combined with speed and transparency. Powering these disruptors are new technologies like artificial intelligence, big data and robotics, which are changing the customer experience; providing unprecedented insights into customer behaviour that help deliver a more seamless money transfer experience. For incumbent players in the market, this new reality presents an opportunity. Businesses should consider leveraging […]

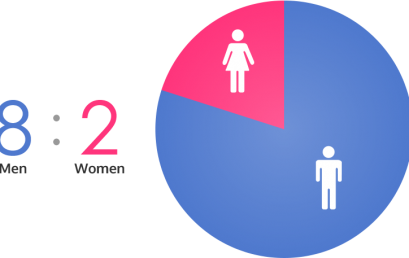

8 out of 10 Aussie Bitcoin traders are men

Eight out of 10 people trading cryptocurrencies in Australia are men, according to joint research by the Australian Digital Commerce Association and Accenture. Eighty-three per cent of the 312,633 customers registered across seven Australian exchanges at the end of 2017 were male, according to joint research by the Australian Digital Commerce Association and Accenture. The exchanges processed more than 2.7 million transactions in 2017 worth a total $A3.9 billion, at an average of $A1,430 per trade. Source: 8 out of 10 Aussie Bitcoin traders are men – SBS News

Xinja launches card and app, gets set to challenge Australia’s banking market

Xinja, which is building the first Australian, independent, 100% digital ‘neobank’, has launched its prepaid travel and everyday spending card and its app. The card is a prepaid, tap-and-go card, with no ATM fees here or overseas, and low international transaction/FX fees that make it a very competitive travel card. The app allows users to lock the card instantly, if it is lost, and is being designed to let users track their spending, with more features to be rolled out over the next few months. The card is being sent out to Xinja’s waitlist, made up of consumers who have signed up to be part of the development of a […]

SMEs trading banks for fintechs, poll suggests

Fintech and other non-bank lenders are set to overtake banks as the preferred source of growth funds for Australian SMEs, the latest Scottish Pacific SME Growth Index suggest. The twice-yearly poll was informed by interviews with more than 1250 SMEs with annual revenues of up to $5 million. Scottish Pacific found that between 2014 and 2018, the proportion of SMEs intending to use banks for funding dropped from 38% to 24%. Meanwhile, 22% of SMEs identified non-bank lenders as their preferred source of growth funds, up from 11% in 2014. In addition, it was revealed that amongst SMEs that have not used non-banking lending options in the past 12 months, […]