Congratulations to the 2019 Finnies Award winners

Congratulations to all the winners at the 2019 Finnie Awards.

Prospa celebrates clean sweep Fintech Lender Award at MFAA

Prospa, Australia’s #1 online lender to small business achieved a clean sweep of the MFAA State Excellence Fintech Lender Award for the second year in a row

SelfWealth and Monash University sign a two-year Industry Collaboration Agreement

SelfWealth, Australia’s fastest growing share trading platform, announces a two-year ‘Industry Collaboration Agreement’ with Monash University.

Australian FinTech company profile #22 – BGL Corporate Solutions

BGL Corporate Solutions develop amazing compliance software solutions simplifying our clients lives with cloud-based, award-winning technology.

The 4th Annual FinTech Awards 2019 launched – Call For Entries

The 4th Annual Australian FinTech Awards 2019 are officially open, with Founder, Glen Frost, calling for Australian fintechs to submit their entries for the 2019 awards.

Fintech State of Origin

Let’s play Fintech State of Origin! To see which is the most predominant Fintech state, we’re carrying out a poll to see which State your fintech is based.

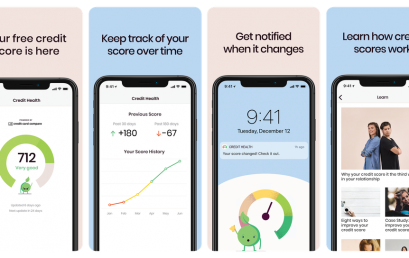

Introducing Australia’s first credit score tracking app

In an Australian-first, a credit score app has been developed to give consumers more access than ever before to their personal credit score.

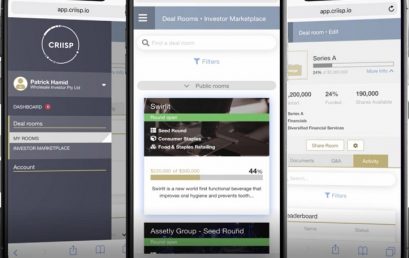

Wholesale Investor launches new end-to-end SaaS capital raising admin platform CRIISP

Australasia’s largest investment platform Wholesale Investor announces the launch of its new SaaS capital raising admin platform CRIISP