Australian FinTech company profile #96 – InvestSuite

InvestSuite provides best-in-class wealth management products to financial institutions faster and at a fraction of the cost versus building them in house.

Green finance and fintech top the agenda as the Lord Mayor of London begins Australia virtual visit

London’s Lord Mayor begins a programme of online engagements with Australian stakeholders promoting closer collaboration in green finance and fintech.

Australian business bank Tyro adopts Mambu’s digital banking platform for its term deposit product

Mambu has announced Australian business bank Tyro has adopted Mambu’s cloud-native banking platform to deliver its first term deposit product.

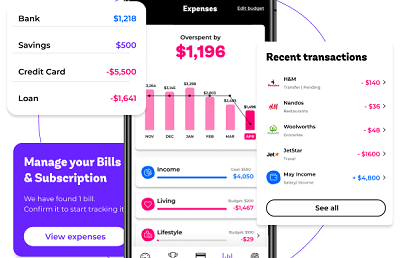

Frollo’s AI turns transaction data into insights

Open Banking leaders Frollo are launching their Data Enrichment API to help their B2B customers turn transaction data into insights.

Quest Asset Partners selects Iress to automate and simplify portfolio management

Quest Asset Partners has selected Iress’ Portfolio System to support greater efficiency and transparency in its approach to portfolio management.

The brains behind Huddle launch Open, a powerful new digital broker platform

Launching OpenBroker™ – a digital broker platform – aims to solve a problem that’s been brewing in the industry over the last few years.

Saxo Markets Australia launches Exchange Traded Options (ETO) on ASX

Saxo Markets has added Exchange Traded Options over shares listed on the Australian Securities Exchange to its online platform.

Wisr receives AOFM funding approval

ASX-listed Wisr announce the AOFM has approved an initial investment of $30.8 million into the Wisr Warehouse through the Structured Finance Support Fund.