Zafin expands in the APAC Region, adds Michelle Tredenick to the board

Zafin today announces the appointment of Michelle Tredenick to its board of directors.

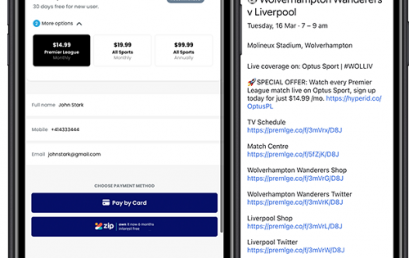

Hyper, a new era in personalised digital payments

Hyper is a digital payments wallet and ID enrichment feature that allows users to make purchases directly from their ECAL calendar.

Navexa updates its portfolio tracking platform and improves service

Australian-based portfolio tracking platform Navexa has announced the latest batch of update and improvements to its service.

Lendi and Aussie Home Loans join forces to revolutionise the future of home loans

Lendi, Australia’s number one online home loan platform, announce the completion of the merger between Lendi and Aussie Home Loans, form the Lendi Group.

Adatree & DNX Solutions partner to provide turnkey Open Banking software and infrastructure solutions

Adatree and DNX Solutions have partnered to provide a turnkey Consumer Data Right SaaS and infrastructure solution for aspiring Data Recipients.

Raiz Rewards continues to grow as Aussies look to instant cash backs from online purchases

Revenue from online shopping continues to rise as more digital buyers turn to online purchases and incentive programs like Raiz Rewards.

Pearler integrates with the Sharesight API

Australian online broker Pearler now integrates directly with the Sharesight API to send transaction data directly to Sharesight.

How eftpos is supporting Australia’s FinTechs

eftpos can help Australia’s FinTechs thrive and grow by providing low-cost access to our national network and real time processing infrastructure.