‘Keeping it simple’ has never been simpler: Global portfolio diversification a breeze with the upgraded SaxoInvestor app

Saxo Bank, parent of the wholly-owned subsidiary Saxo Australia, has launched its new and improved SaxoInvestor app, helping investors around the world “keep it simple” when building a globally diversified portfolio for the long term.

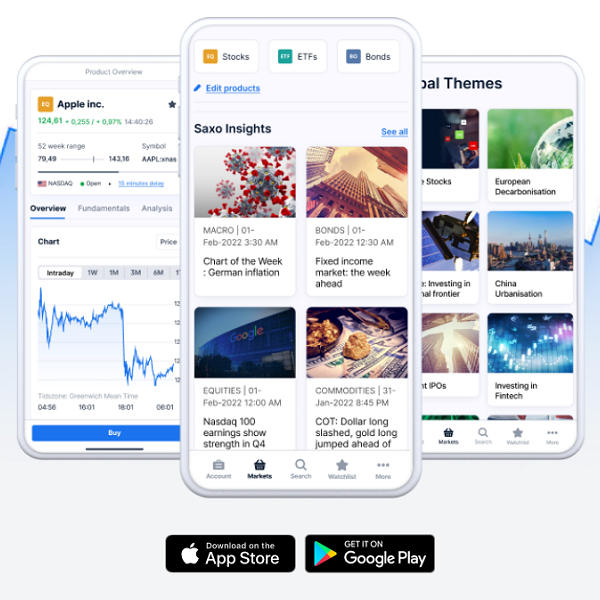

With its clean new look and feel, the upgraded SaxoInvestor app makes diversification across stocks, ETFs and bonds from 30+ global markets a breeze, from investment inspiration to execution.

“At Saxo, our North Star is helping curious investors build a globally diversified portfolio – because we know that, over the long term, that’s the only way to create wealth, ride out market volatility, and prosper,” Saxo Chief Commercial Officer Stig Christensen said.

“For this reason, we believe it should be simple and affordable to buy stocks, ETFs and bonds from a range of markets around the world – and we work every day to make this vision a reality.

“We know that about 60% of client interactions with Saxo occur via mobile, so we couldn’t be happier to unveil the upgraded SaxoInvestor app for our digitally-savvy investors.”

The new SaxoInvestor app, built upon the detailed feedback of Saxo’s 1.2 million clients around the world, delivers several enhanced features:

- A new, more intuitive menu structure and enhanced navigation tools.

- Updated, user-friendly product pages for stocks, ETFs and bonds.

- A revamped News Hub for market research, insights and inspiration, so investors can navigate the markets and seize on fresh investing opportunities.

- A fresh, customisable portfolio tab to track investments and watchlists.

At the same time, a few key things won’t change:

- Access to 35,000+ equities, ETFs and bonds across 30+ global markets.

- Saxo’s razor-sharp brokerage, with US stocks from just USD 1.

- Saxo Australia’s parent company, Saxo Bank A/S, which has an A- S&P credit rating and has been designated a “Systemically Important Financial Institution” in Denmark.

“We are always listening and responding to feedback from our valued clients, and we use this each and every day to improve our platforms and services. We look forward to unveiling improvements to our SaxoInvestor desktop experience, as well as our SaxoTraderGO app, in the near future,” Christensen said.