Volt selects Frollo to launch BaaS-powered apps

Australia’s first neobank Volt has partnered with Australia’s first Open Banking intermediary, Frollo, to jointly build and launch a new banking-as-a-service (BaaS) app that is fully integrated with Volt’s core banking system, and can be white labelled for Volt’s BaaS customers.

In addition, Volt will become the first lender to use Frollo’s open banking-powered ‘Financial Passport’ to automate its lending decisions through a real-time, accurate, and complete assessment of the borrower’s financial situation.

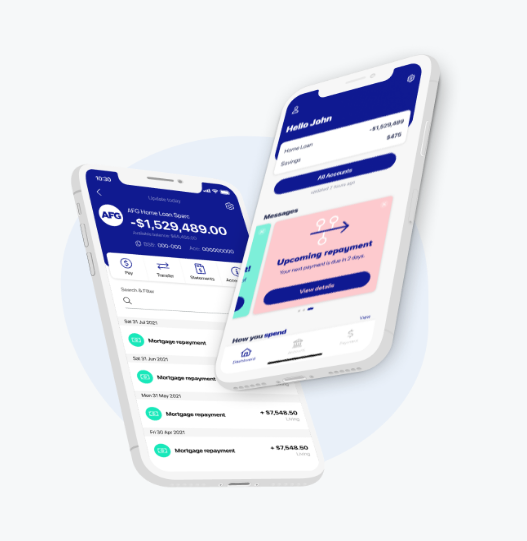

Volt’s first customer to roll out a BaaS-powered app is one of Australia’s largest broker groups, Australian Finance Group. AFG launched its ‘Handl. By AFG’-branded customer app for a pilot group of 125 brokers in October and will roll it out to all of its 3,050 brokers in early 2022.

The app allows AFG customers to see and manage their AFG Sparc home loan product, open and manage a Volt Savings Account, make payments and manage a Volt debit card from the one app.

The Volt BaaS app will also offer a range of critical open banking benefits that will deeply improve a wide range of personal finance management (PFM) functions for users, who will be able to link accounts from over 80 other financial institutions to get a real-time view of their financial position.

All transactions will be categorised using AI-powered transaction enrichment, which automatically identifies merchants, bills, and pay days, enabling users to plan ahead and stay on track financially.

Given the long standing existing partnership between Volt and Frollo, the move to work with Frollo to launch Volt’s new banking apps was a logical one according to Volt.

Steve Weston, CEO and Founder of Volt, said, “Frollo is the Australian market leader in open banking, and has worked with us from day one to deliver great money management experiences for our customers in our Volt Labs and Volt Bank apps.

“Frollo also helped us test our Data Holder solution and helped us with our Data Recipient accreditation, so when it came time to build a next-generation banking app with a full suite of open banking and PFM features to accompany our new BaaS offering, they were the obvious choice.”

Gareth Gumbley, CEO and Founder of Frollo, said, “We have had a great relationship with Volt over the years. With its BaaS offering they’re in a unique position to fully leverage the power of open banking, and it’s amazing to help them bring this to life. We’re looking forward to many more of their clients launching, using our technology to deliver better customer outcomes.”

Volt’s former consumer app will also be updated with the new build, which will give customers a full overview of their finances, insights on how to improve, and the tools to act on them through smart insights, nudges, and spend graphs.