Two-thirds of Australians want to use Open Banking to switch banks

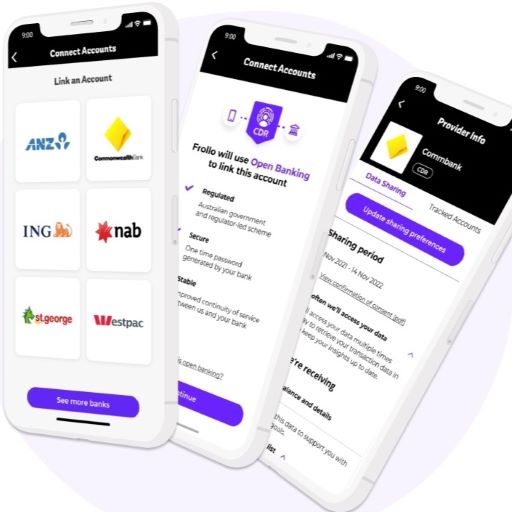

Frollo, the Australian leader in Open Banking, has published ‘Open Banking – The consumer perspective’, a report on consumer attitudes toward sharing financial data by linking their accounts.

The report shows that Australian consumers see real value in services like bank switching (68%), a full financial overview (61%) and streamlined mortgage applications (58%) but they’re hesitant to trust businesses with this data. Banks are the most trusted (51%), followed by utility companies (37%) and brokers / financial advisors (35%).

Consumers value the protections that Open Banking provides: 91% of Australians say privacy is important when sharing their financial information. Security (88%), transparency (88%) and control over their data (88%) are other important considerations for Australians.

The Open Banking opportunity

Frollo CIO Tony Thrassis says: “This research confirms that consumers want the products and services Open Banking enables. Case in point: Two-thirds of Australians want to use Open Banking to switch banks.

To capture this excitement and make Open Banking successful, organisations need to focus on building use cases that deliver immediate, demonstrable value to their customers.

Understandably, in sharing financial information trust is a challenge for consumers. For years they’ve been warned about the dangers of sharing their account credentials.

The report is based on a representative sample of the Australian population (18+), of 1,066 respondents.

This is why government, banks and Data Recipients need to educate consumers on how Open Banking puts them in control of their data. But words aren’t enough, we need to show them they are in control. That they actually decide how they use their own data, who they share it with and for what purpose.

And where Open Banking is available, we need to get rid of less safe and transparent alternatives like screen scraping.”

The consumer perspective on Open Banking

‘Open Banking – The consumer perspective’ highlights immediate opportunities for Open Banking in Australia and reveals insights into consumer attitudes toward sharing their financial data.

The four key insights are listed below.

Key insight #1

Australians value Open Banking powered products and services

When we asked Australian consumers about six potential Open banking use cases and how useful they would find them, a clear picture emerges: Australians see the benefits of Open Banking.

Close to two-thirds think linking their bank account to share financial data and get access to personalised products and services is useful.

The most useful service is using Open Banking to switch over payee and direct debit details to a new bank (bank switching). More than two thirds (68%) of respondents said they would find this useful.

Key insight #2

Privacy, security and control are key differentiators for Open Banking

Traditional ways of sharing financial data, have consumers share their account credentials or email payslips and bank statements as PDFs. The many privacy and security risks associated with these methods leave consumers wondering if their bank accounts are still secure, who has their data and what it’s being used for.

Privacy, security and control are important to consumers when they share their financial data, and Open Banking is built with this in mind. With 98% of consumer deposits covered by Open Banking, it’s time to start phasing out risky alternatives like sharing account credentials and emailing bank statements.

Australians want to know their data isn’t shared with third parties without their consent – 91% say privacy is important when sharing their financial data.

Other important considerations for Australians when sharing their financial information are security (88%), control (88%) and transparency (88%).

Key insight #3

Trust has to be built

Most Australians are hesitant to trust institutions with their financial data. Banks are most trusted, 51% of Australians would trust them enough to share financial information with them by linking their accounts.

More than one-third of Australians trust utility companies (37%) and brokers/financial advisors (34%) enough to share their financial history by linking their accounts.

Big technology companies (27%) and fintechs (23%) are the least trusted when it comes to sharing financial data.

The two biggest concerns consumers have are whether businesses will keep their data safe and whether they have their best interest at heart.

Key insight #4

Millennials and Gen Z are likely the first to get on board

Across the board, there’s a clear relationship between age and willingness to engage with Open Banking. From the appeal of products and services to trust, the younger demographic is undoubtedly more responsive to the changes Open Banking can bring.

And on the flipside, privacy and security concerns are less of a barrier.

The generational differences are most pronounced for two use cases in particular: A full financial overview was found useful by 80% of Gen Z, and 74% of Millennials, compared to 61% of all Australians. A similar divide is evident for streamlined mortgage applications – found useful by 78% of Gen Z, 72% of Millennials and 59% of all Australians.