SocietyOne sets new record with triple milestones in 2017

SocietyOne, Australia’s pioneering and leading consumer marketplace lender, has set new records for lending with growth in 2017 already surpassing the level of volumes for the whole of 2016.

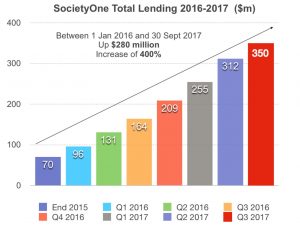

Total lending since the company started operating five years ago has now topped $350 million as the current loan book also reached $200 million for the first time in SocietyOne’s history.

These were new records for a consumer finance marketplace lender in Australia with SocietyOne having originated more than twice the loans than that of the company’s nearest competitor. SocietyOne has now enjoyed seven successive quarters of strong growth as it scales up.

New lending to borrowers in 2017 has so far totalled $141 million, topping the $139 million which was advanced over the course of 2016.

Jason Yetton, CEO and Managing Director of SocietyOne, said: “We have continued to build on the strong momentum achieved in 2016 and have seen sustained year-on-year growth with comparable lending volumes now above the levels achieved for the whole of last year.

“Our growth in 2017 underlines the demand from consumers for a real alternative to the major banks. Consumers are looking for a better deal on their finances and our risk-based pricing is attractive for customers that have demonstrated that they have a good credit history.

“Customers have responded positively to a number of improvements we have delivered over the past year. These have included a strong focus on better service outcomes and speed of loan approvals, increasing the maximum loan amount on personal loans to $50,000 and continued success with our advertising and marketing activities, including the “Make It Happen” campaign that launched in June.

“Our customers are also loving the differentiated service experience that we offer. We have had more than 600 customer reviews on ProductReview.com.au with an average rating of 4.7 out of 5. We also track Net Promoter Scores on our lending and this now stands at +63.”

Of the $350 million of lending to date, $270 million has been advanced to consumer borrowers as personal loans and $80 million to farmers via their agents through SocietyOne’s unique secured livestock lending product.

Launched as a pilot in March 2014, SocietyOne AgriLending is now scaling up and during the third quarter was recognised for its support of Australian cattle and sheep farmers at the 2017 Australian Business Banking Awards by being named as a finalist in the industry specialisation category. The last quarter saw improvements to both the product and the technology platform.

The first three-quarters of 2017 have also seen a record amount of funding made available by investor funders with new mandates secured from existing and new institutions and high net worth individuals. The total number of funders since inception has risen to 320 and committed available funding as at 30 September 2017 stood at $61 million.

SocietyOne enjoys strong support from the customer-owned banking sector with the number of mutual banks and credit unions as funders now numbering 20. Mutual institutions have to date provided $100 million of funding out of the $350 million advanced to borrowers.

As for the outlook, Mr Yetton said the company was looking forward to another strong quarter ahead and welcomed moves by the Federal Government to encourage more competition in the banking sector by legislating for comprehensive credit reporting and open banking.

“With a more dynamic approach to both comprehensive credit reporting and open banking on the horizon, Australians are becoming increasingly aware of the better choices now available,” he said.

“As the undisputed leader in marketplace lending for personal loans, our customers are clearly telling us there are more attractive ways to sort out their finances, whether it is consolidating credit card debt, renovating their homes, buying a car, going on holiday or paying for a wedding.

“I’m also pleased at the way we are getting behind Australian livestock farmers as the growth in SocietyOne AgriLending has shown. The team is standing ready to help them even more so as rural and regional Australia waits for the rains that will kick start the Spring growth and rearing season.”