Smartbank 86 400 brings super and investment into focus with Connected Accounts

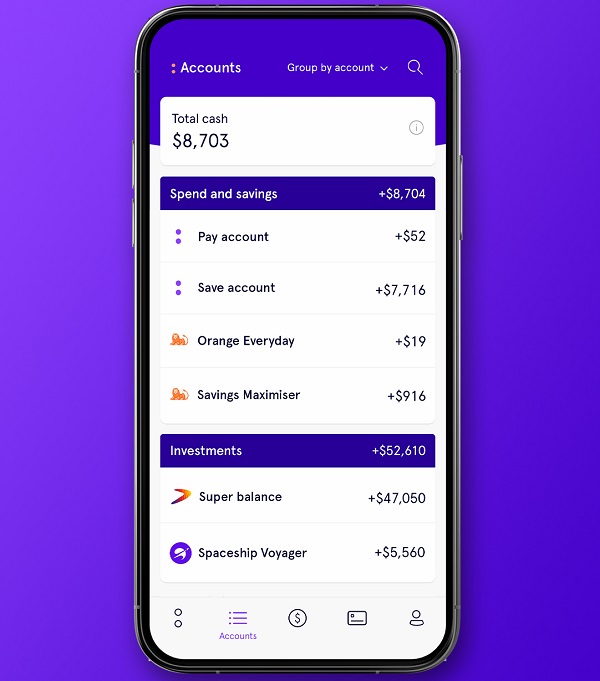

Australia’s first smartbank 86 400, is enabling customers to connect and see the balances of their superannuation and investment accounts, providing Australians with an unmatched view of their finances – from transaction and savings accounts to home loans, personal loans and credit cards, and now to super and investments – all in one place.

In a highly anticipated extension of its Connected Accounts feature, 86 400 becomes one of the only banks in the Australian market that enables customers to connect their super and investment accounts from external financial institutions and providers – adding a new layer of visibility for people to track their financial standing.

Knowledge is power

Smart banking has been in 86 400’s DNA since its inception, with Connected Accounts at the core of its purpose to help every Australian take control so they can feel on top of their money. Using smart technology, the Connected Accounts feature digitally unifies users multiple bank accounts and financial products under a single point of access – giving people a clear, holistic view of their money in a banking app, including:

- Predicted bills and subscriptions through the ‘Coming Up’ feature across all Connected Accounts

- Smart Search: One simple search to view your spending across all your Connected Accounts

- Budgeting insights: Tracking money in and out of your individual and shared accounts in line with your pay day cycles

- Set up direct debits and recurring payments straight from your Save account

- All payment options: Apple Pay, Google Pay, Samsung Pay, BPAY, OSKO, and more

86 400’s smart Connected Accounts feature currently supports 128 financial institutions, with the enhanced offering set to add over 50 super and investment providers.

Bank smart with a bigger picture

The past couple of years has seen a significant shift in the financial landscape and the way Australians manage their money. Changes to superannuation contribution rates implemented this year meant that more of people’s salary is being directed towards super than ever before. Despite the bump to a guaranteed 10 percent rate, most Aussies don’t have regular visibility of their super and are blind to how much they have sitting in their accounts, the fees and insurance they’re paying, and how it’s performing, to help support a comfortable retirement.

Living in a low interest environment, customers young and old are exploring investment options to help generate a higher return than traditional savings accounts. 86 400 is committed to making it easier for people to see all of those investments and take control of their longer term financial well-being.

Travis Tyler, Chief Product & Marketing Officer of 86 400, said, “We keep our finger on the pulse of customer feedback and this new layer of Connected Accounts functionality has been one of the most requested features, revealing a gap in the market and in people’s view of their money. The evolution of our Connected Accounts helps Australians unblock the financial blindspots around superannuation and investment portfolios. At a time of uncertainty in the market, we want to empower our customers with a greater view of their true financial position, now and in the future.”

Nicole Burke, Head of Digital Product at 86 400, added, “Staying on top of your finances shouldn’t be complex. We’ve brought dispersed financial information into focus, helping Australians to feel more in control of their money. The introduction of connected super and investment accounts will show customers exactly where their money sits and how it’s performing.”

Despite the unprecedented challenges brought by the pandemic over the past 18 months, 86 400 has continued to provide customers with a smarter alternative to the way they bank today, empowering Australians to take control of their financial future.