Unemployment and low savings driving Greater Sydney “Shadow Pandemic” of financial stress: survey

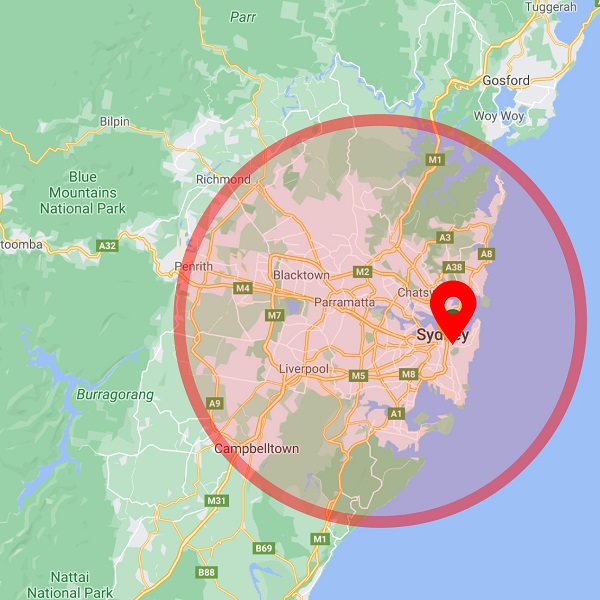

A recent poll conducted by Savvy of 1002 Greater Sydney residents living in COVID-19 lockdown restrictions shows a “shadow pandemic” of financial stress plaguing Greater Sydney, driven by unemployment, underemployment, and rapidly depleting savings – 10% of respondents saying they have $1,000 or less in savings, 9% have $500 or less, while 8% stated they have no savings at all.

- 12% of survey respondents have lost employment

- 15% “extremely worried” and 12.9% “worried” about losing income if lockdown continues over next three months

- 27% have $1,000 or less in savings

- 35% are living paycheque to paycheque

- 32% pessimistic about finances for remainder of 2021

12% of respondents reported they have lost employment and 22% said their hours have been reduced. Of those who are currently employed, 15% said they are “extremely worried”, while 12.9% are “worried” about losing their income if the lockdown continues over the next three months.

35% say they are living paycheque to paycheque; cause for concern when extrapolated to the whole of Greater Sydney’s 5.3 million residents.

Financial wellbeing in terms of savings have faltered, with 46% saying their savings have been reduced, equating to 464 of 1002 total respondents. 19% said they are saving more during the lockdown however, with the highest group surprisingly being in the 18–24-year-old cohort.

29% of respondents said they have at or below one month worth of savings to keep them going; 19% say they have three months’ worth, while 31% say they have six months to a year’s worth saved up.

As for seeking relief, 50% of respondents say that they will seek government support such as Centrelink or the COVID-19 Disaster Payment. 21% said they’re willing to use their credit cards; 12% said they will redraw on home equity. 27% say they will borrow from family.

Savvy Managing Director Bill Tsouvalas says that there may be another “shadow pandemic” of indebtedness and insolvency unless there is more support, financial relief, or an opening up of the economy.

“As we all know, the longer this goes on and the less income we can all generate through productive work, the more it puts our economy in a precarious position. 29% of respondents, or 293 people, said they could only keep themselves going for another month if they are to become solely reliant on savings. After that, who knows what will happen to these people?”

“All these measures will inevitably make people worse off financially the longer this continues.”

41% of respondents said that they do not accept the economic cost of the current NSW Government position of locking down the population to achieve zero community transmission. As of the 20th of August, NSW recorded 646 new COVID-19 cases, resulting in 16,164 active cases in the state.

The Commonwealth Government’s next phase out of “aggressive suppression” is contingent on 70% of the Australian population being fully vaccinated. The current national total is 28.2%, with NSW on 29.3%. Prime Minister Scott Morrison says that this could be achieved by Christmas. With savings running out and employment opportunities dwindling, this leaves two million Sydneysiders with little hope for a financial reprieve. As a result, 32% of respondents are pessimistic about their finances for the remainder of 2021.

“If lockdowns continue without additional support from government or elsewhere, Australians may have no Christmas to look forward to in a financial sense,” Tsouvalas warns. “Something must be done to balance the economic cost with the health benefits of continuing lockdown.”