Class maximises efficiencies for clients through delivering independently certified and automated data feeds

Class today announced it has obtained the latest assurance certification under the Auditing and Assurance Standards Board’s ASAE 3402 framework.

Five tips to help reduce costs & maximise value from your business tech subscriptions

At ExpenseOnDemand have recently commissioned an extensive survey of business leaders, to understand how firms are utilising their tech subscriptions.

BNK to buy $150m residential mortgage book from Goldman Sachs

BNK have announced that we have bought $A150 million worth of high-margin residential mortgages from a warehouse financed by Goldman Sachs.

DTCC identifies how enhanced data exchange and management can propel new insights across firms and markets

Depository Trust & Clearing Corporation (DTCC) has issued a whitepaper, “Data Strategy & Management in Financial Markets.”

Square launches new tech to help Aussie businesses tackle holiday rush

As the end of year sales rush approaches, Square has launched two of its powerful, vertical-specific software solutions.

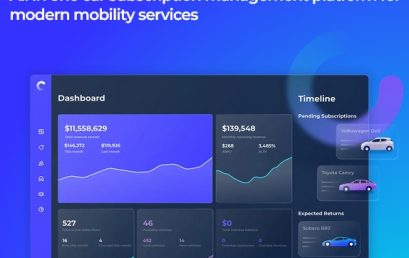

Loopit announces new partnership with RentalMatics as integrated telematics provider

Loopit has announced RentalMatics as its newest integrated telematics provider, offering fleet management services for Loopit customers.

Riskified and Novatti enter exclusive partnership to provide secure payment solutions powered by best-in-class chargeback guarantee

Novatti becomes the first online card processor to offer Chargeback Guarantee to eCommerce businesses across the APAC region.

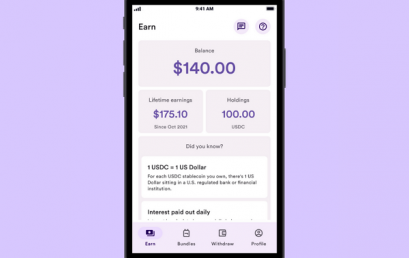

Chillur launches new investment offering allowing Australians to maximise their savings

Chillur has launched Chillur Earn allowing Australians to make the most of their tax returns amid rising costs of living.