SelfWealth’s CEO Cath Whitaker resigns

ASX-listed trading platform SelfWealth have announced the resignation of its Chief Executive Officer, Cath Whitaker, with immediate effect.

Fifo Capital unveils “Digital CFO Technology” SaaS platform, Fifopay, to transform Aussie SMEs’ financial management

Fifo Capital has announced the public release of Fifopay, a cloud-based, AI-enabled financial management platform designed to revolutionise SMEs’ financial operations.

Banjo Loans’ top tips for getting into tip top shape for this EOFY and FY24

As the end of financial year rapidly approaches, you may be feeling a tad overwhelmed with your ‘to do’ list longer than the lyrics in Bohemian Rhapsody.

Arctic Intelligence responds to proposed AML/CTF reforms

On 20 April 2023, the Attorney General’s Department (AGD) announced a public consultation of proposed reforms to Australia’s anti-money laundering and counter-terrorism financing (AML/CTF) regime.

BSA Conference 2023 round-up: essential takeaways for building societies

The Building Societies Association Annual Conference 2023 is a valuable opportunity to connect with people from all levels of the sector and is always a source of inspiration for those of us attending from Sandstone Technology.

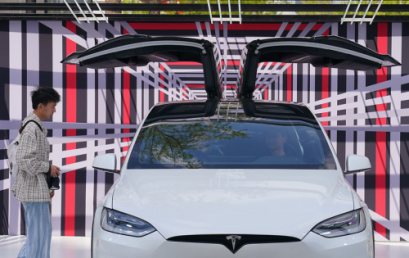

Tesla showcases significant subscription growth, as new automaker brands and models enter the Loopit subscriber network

In the latest Vehicle Subscription Utilisation (VSU) Index, Tesla has taken a considerable leap, climbing up 9 spots in the ‘Top 20 Subscribed Vehicles by Make’ category.

Management consultants launch fintech startup Upworth

Former consulting duo Alexandre Chavotier and Maxime Chaury, along with Co-Founder and Chief Technology Officer Carlos Ríos, have launched a financial planning and money management platform called Upworth.

Stake appoints Geoff Lloyd as Chairman as it doubles down on long term growth

Australian brokerage platform Stake has appointed Geoff Lloyd as Chairman, as it strengthens its position as the home for ambitious investors.