10 questions from Frollo’s webinar: Comply and Compete with Open Banking data

Here is an update and 10 questions from Frollo’s recent webinar: Comply and Compete with Open Banking data.

Cash warns banks to reduce ‘tap and go’ fees

Senator Cash stated that many retailers had raised concerns that banks are not offering to send ‘tap and go’ payments down the cheapest payment network.

Open Banking has arrived and is here to stay but how should banks take charge?

The imminent arrival of Open Banking is scheduled for rollout across Australia’s top four banks this July with other financial institutions to follow.

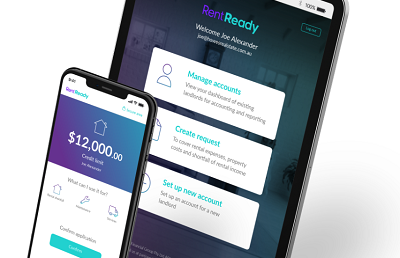

RentReady launches the first pay later solution in Australia for landlords

ASX-listed MoneyMe announce the launch of RentReady, a first to market pay later solution to help agents and landlords better manage investment properties.

Traders in Australia can now make hassle-free payments to China in USD and other major currencies with Harbour & Hills

Traders, corporates and SME/VSE businesses Down Under can now make hassle-free payments to China in USD, EUR and other major currencies.

UK Fintech TransferWise enables Australian dollar direct debits, introduces “Pay with TransferWise” with Xero

TransferWise account holders can also manage all direct debits from their accounts, and receive notifications about upcoming payments or low balances.

Switching banks with one click can reshape financial services

The possibilities of open banking are frightening for the banks, which could have customers switching banks with a simple click.

Revolut finally secures Aussie licence

An ASIC spokesman confirmed that Revolut had been granted a licence to market non-cash payment products to retail and wholesale clients.