Thank You & Merry Christmas!

From the team at Australian FinTech, we’d like to say a massive THANK YOU to everyone who has supported us over the past 12 months.

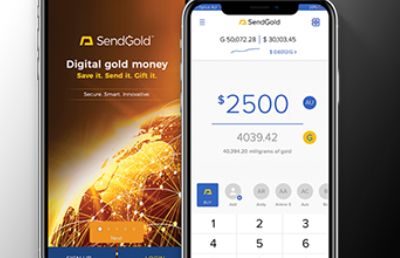

Award-winning Australian Fintech SendGold secures funding from leading wealth manager

Australian Fintech SendGold announce that it has received investment from several Melbourne-based family offices led by EL&C Baillieu.

Australia’s major banks take financial hit as market intensifies

Australia’s major banks have had a tough year, with a substantial decline in cash profits and a falling share of the mortgage market

SendGold announces crowdfund via Birchal

SendGold has recently launched their anticipated investment EOI on the Australian crowdfund platform Birchal.

This female entrepreneur is building one of Australia’s first Neobanks

For Van Le, Co-founder of Neobank Xinja, the key to being a successful entrepreneur is to have a purpose bigger than yourself.

Nimble to exit payday lending

“While we transition from the payday lending market, we are building a strong suite of products which will eventually fill this void,” said CEO Gavin Slater.

How Arctic Intelligence is revolutionising RegTech to transform compliance

Anthony Quinn, CEO and Founder of RegTech company, Arctic Intelligence, is leading the charge to prevent financial crime.

New study shows digital marketing skills, financial literacy on wish-list for Aussie small business owners

A study of small business owners in Australia reveals they need digital marketing skills and improved financial literacy to manage and grow their business