Nimble links system performance to customer experience to help shed pay day lender tag

“Micro lender” Nimble says correlating system performance to customer journeys is allowing it to improve the customer experience.

Household Capital 2020 Third Pillar Forum

Household Capital’s 2020 Third Pillar Forum launched today as an online experience hosted at householdcapital.com.au/third-pillar-forum.

Judo Bank selects nCino’s cloud solution to help Australian SMEs

Judo Bank, a unicorn dedicated to lending to Australian small and medium sized enterprises (SMEs), will implement nCino’s Bank Operating System.

OpenMarkets closes out Big Bank to take No.4 retail stockbroker position

OpenMarkets has overtaken nabtrade by traded value, becoming Australia’s fourth largest retail stockbroker for the first time.

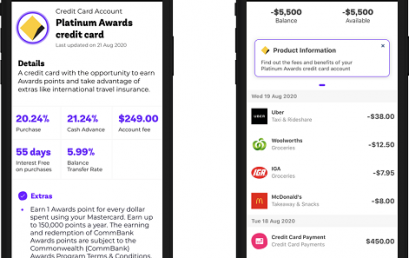

Frollo first app to use Open Banking product information

Frollo, a leader in B2B Open Banking solutions, has achieved another Australian first by making CDR product information available to its app users.

Class Limited launches trust accounting product, Class Trust

Class Trust enables accountants, financial advisers, and administration professionals to automate significant parts of the trust administration process.

Mambu set to make waves Down Under, appointing award-winning fintech leader Kristofer Rogers as new MD ANZ

Mambu has welcomed award-winning fintech leader Kristofer Rogers to the newly created role of Managing Director for Mambu Australia and New Zealand

SocietyOne rapidly flattens 2000% Covid hardship spike through award-winning tech

SocietyOne has flattened a 2000% spike in hardships after developing and implementing a tech solution to manage the surge of hardship requests.