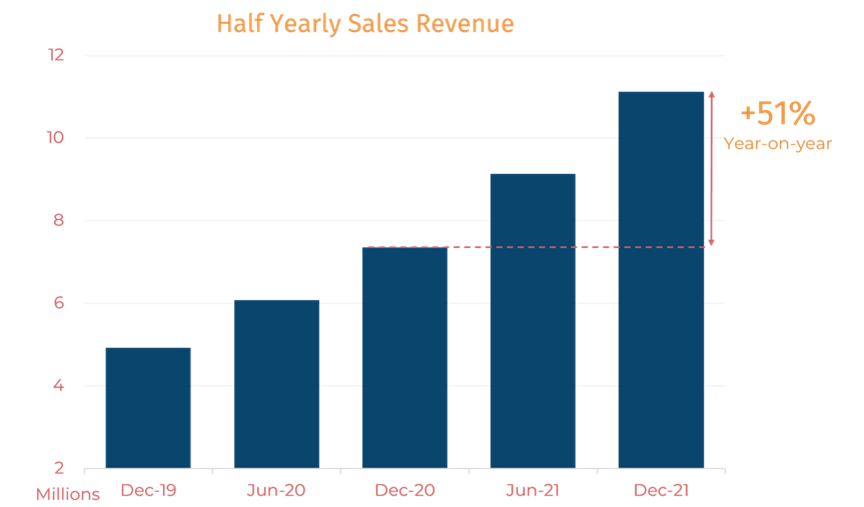

Novatti’s revenue growth continues upwards

ASX-listed Novatti Group Limited, a leading fintech enabling businesses to pay and be paid, has provided an update on its performance and revenue growth for the first half of FY22.

Commenting on the results, Novatti Managing Director, Peter Cook, said, “The first half of FY22 saw Novatti continue its consistent 50%+ growth rate, with two consecutive quarters of record revenue resulting in combined H1 sales revenue of $11.1m and total revenue of $12.3m. It is worth putting this growth in perspective – our first half sales revenue is now greater than Novatti’s total sales revenue for FY20, just 18 months ago, highlighting the strong growth journey we are on.”

“Novatti’s processing business continued its strong performance with 113% year-on-year first half revenue growth, to $9.1m. The growth in this business highlights the benefits of Novatti’s transactional revenue base and its ability to scale. We expect this scaling to continue as all our businesses, but particularly processing, increasingly leverage our now global operating base including Asia, North America, Europe and the UK, and of course Australia.”

“At the start of the first half, we laid out a new growth strategy focused on entering new and expanding our existing markets, pursuing acquisitions, and capitalising on our strategic investment in Reckon Limited. Our first half results, and the investments we’ve made, highlight that we are wasting no time in delivering against this strategy.”

“Our 19.9% strategic stake in Reckon Limited has already delivered a $676k dividend in its first six months as we also explore a broader business relationship between Novatti and Reckon. As a first step, we are well progressed in the launch of an integrated payments solution that would seek to add value to Reckon’s 114k+ users.”

“We announced and subsequently completed the acquisition of ATX, a leading fintech in South-East Asia. The acquisition of ATX strengthens Novatti’s growth platform in South East Asia, bringing with it a network of more than 30k+ payments touch points.”

“Across the half we continued to invest heavily in our ecosystem and expanding our operations globally. We see the strength of our ecosystem, including our technology, licences, partnerships and team, as being central to our continued growth as it is increasingly leveraged globally to scale our revenue base.”

“The centerpiece of our ecosystem is our team, with our investment here clear in our financial results. Across calendar year 2021, we increased our team by more than 70% to 150, with a particular focus on hiring new talent in sales, business development, and operations. This investment is invaluable to Novatti’s future growth, particularly as we scale our newer businesses, such as acquiring, which is gaining momentum and creating long-term, reliable revenues for Novatti. The growth potential of this business was further strengthened during the first half by securing acquiring licences from both Visa and Mastercard.”

“We recognise that the development of some of our new business takes time to deliver. This is clearly the case for our new banking business, which has been several years in development. However, building this new business remains a key part of our long-term growth strategy as we continue to see the increasing demand from consumers and investors alike for fintech-led innovation and new service offerings in Australia’s banking sector.”

“Importantly, we are increasingly positive about a near-term decision on the bank licence as we work closely with Australia’s banking regulator.”

“After a record first half, we’ve moved into the second half carrying great momentum. Novatti is in an exciting phase of transitioning from development to monetisation, particularly as our transactional revenue streams begin to leverage our now global operating base to scale.”

“Importantly, we are entering this next growth phase with a strengthened balance sheet, having increased net assets by nearly 370% across the half.”

“We are very excited about Novatti’s future growth and remain absolutely focused on delivering on our growth strategy to get us there.”