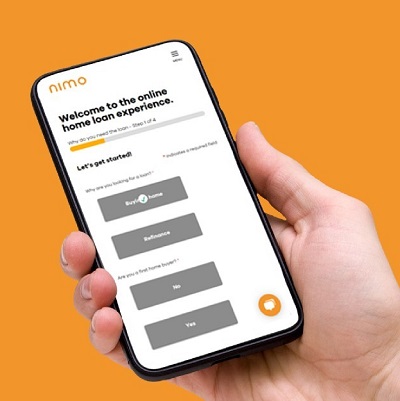

Nimo launches SaaS platform to help lenders provide home loans online

Melbourne fintech Nimo Industries has today launched a SaaS platform for financial institutions and brokers that enables them to service home loan customers purely online.

Nimo’s SaaS platform will enable lenders to benefit from a digital-first, customised, cost-effective and scalable approach to bringing their home loan products to market.

Peter Jones, CEO of Nimo Industries, said the platform will offer a seamless digital experience to customers, as well as minimising friction in the home loan process, reducing loan approval times and the number of lost sales.

“Nimo allows financial institutions to prioritise customer experience without relying on costly and inflexible infrastructure or increasing back-end operating costs. With Nimo the creation of an online lending platform becomes a ‘buy’ decision, freeing up lenders internal ‘build’ capabilities to focus on more core business priorities.

“Internal complexity has traditionally been a barrier to meeting rapidly changing customer expectations, so by bringing in digital capability that is essentially ‘plug and play’, lenders can innovate quickly, start small then scale and customise when they need to.

“With the priority that COVID-19 brings for changing service propositions, Nimo can provide a simplified home loan process that customers can complete in comfort on their couch,” said Mr Jones.

As well as providing industry leading customer experience, agility, cost and scalability benefits, Nimo is built to support NCCP Responsible Lending compliance obligations and guarantees high level security.

“Protecting customer data is of utmost importance, which is why we use the latest scalable encrypted systems offering up to Bank level security to protect customer data”, said Mr Jones.

Nimo is available through a subscription model and the ‘starter’ package is on offer free to eligible lenders to assist during COVID-19 for a period of three months.