HUB24 platform adds new data feeds to enable complete view of client wealth

As part of HUB24’s commitment to continuing to deliver innovative solutions that meet emerging adviser and client needs, the company today announced it has added new data feeds and automation capabilities to its platform, enabling advisers to report on clients’ other investments including cash accounts and term deposits, listed securities, managed funds, direct property, and other assets.

As the demand for better reporting tools to support client engagement continues to grow, data feeds from platforms are being increasingly relied upon by advisers to increase efficiencies in their practices and deliver client value. With 51% of advisers manually preparing reporting on their clients’ non-custody assets, it’s becoming increasingly important for advisers and their clients to integrate data from outside of the platform to deliver a complete picture of their clients’ wealth.

HUB24 Chief Product and Innovation Officer Craig Apps said the new features have been designed in collaboration with advisers and offer many benefits including saving advisers more time by leveraging HUB24’s data & technology capability to create efficiencies, increase client engagement and deliver value.

“The new automated feeds are the latest addition to a series of product enhancements made available this year. By leveraging this capability, advisers using the HUB24 platform can obtain a holistic view of their clients’ asset allocation simply by adding in other investments such as property values, other Australian or international shares, private equity funds or even collectibles such as art or wine.”

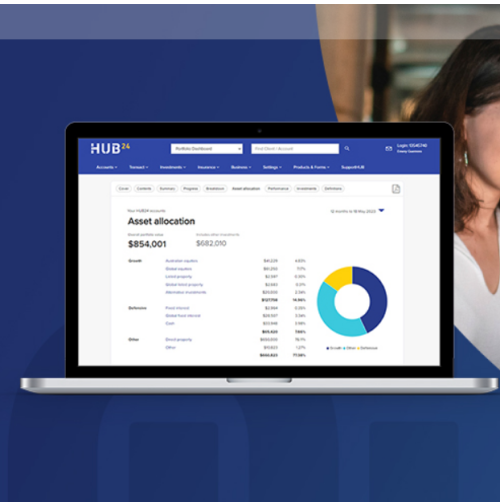

Once an adviser adds other investments to the HUB24 platform, they are integrated across HUB24’s Portfolio Dashboard, InvestorHUB and HUB24 Present, a market-leading reporting capability co-created with advisers that enables them to customise presentations in real-time and increase client engagement.

Apps said, “Through ongoing discussions with advisers, we identified a range of other features that would make it easier for advisers to have more holistic conversations with their clients. As a result, advisers now have the ability to customise the terms used for asset classes, for example, ‘listed infrastructure’ versus ‘alternatives,’ enabling them to use consistent language that their clients understand across multiple documents, which also supports compliance processes.”

By collaborating with advisers and licensees and embedding a culture of innovation, HUB24 continues to deliver market-leading solutions that empower advisers to deliver scalable, cost-effective, and efficient value propositions.

In the most recent Investment Trends 2023 Adviser Technology Needs Report Industry Analysis, HUB24 was rated number one for its client reporting and review tools with advisers commenting the reporting capability upgrades are ‘fantastic’, the functionality a ‘game changer’ and the presentation feature ‘brilliant’, significantly reducing the time required for reviews and allowing advisers to see a clear picture of their client’s performance and other metrics.

Kelly Wealth Senior Financial Adviser and Partner Dave Haydon, who is a regular user of HUB24 Present, said the reporting functionality leads to richer client discussions and engagement.

“HUB24 Present is one of the best platform improvements I’ve seen recently. With the addition of ‘other investments’ enhancement and the cash data feeds, HUB24 is delivering one ‘mic drop’ platform hit after another.”

Ethinvest Financial Adviser and General Manager Fiona Thomas has also found HUB24 Present valuable her in her practice.

“HUB24 Present allows us to quickly prepare a visually appealing and simple PDF, or an interactive set of slides to take a client through their portfolio over whatever timeframe we choose.

“We’ve also been able to incorporate extra elements that are important to our clients, such as the social and environmental impact of their portfolio, alongside the traditional asset allocation and performance information you would expect. This is a real value add for our business.”