Global market turmoil drives weakest start to financial year in five years for managed fund flows: Calastone

Australian investors have started the financial year in a sombre mood, according to the latest Fund Flow Index from Calastone, the largest global funds network.

Managed equity funds saw inflows of just A$705m during the seasonally important start to the financial year. This was the weakest Q3 on Calastone’s five-year record, with inflows down 81 per cent year-on-year and down 89 per cent compared to July to September 2021. All the buying was focused in July, which saw inflows of A$844m, as the stock market rallied modestly during the month, yet by August, buying had turned to selling and outflows continued through to the end the quarter.

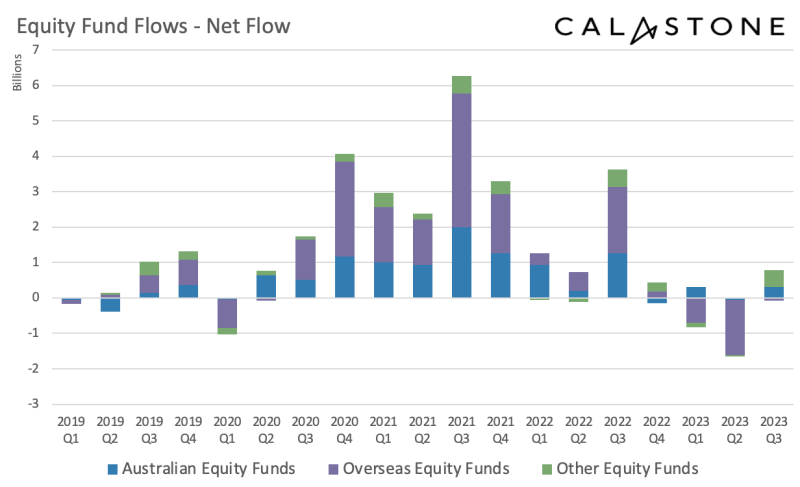

Net equity managed fund flows, Q3 2023

Funds investing in domestic equities saw inflows but overseas-focused funds saw outflows

Sentiment towards overseas markets turned negative more sharply than towards funds focused on domestic stocks. A little under half of Q3’s new capital that flowed to equity managed funds was directed to funds investing in Australian companies – a net A$306m for the quarter, as inflows continued into August and September, albeit at an ever-diminishing rate. By contrast, funds investing in overseas equities saw similar inflows in July turn to brisk outflows by September, resulting in net selling of A$77m for the quarter overall.

Infrastructure funds attracted the most inflows in Q3

Sector funds attracted the lion’s share of Q3’s new capital to managed equity funds. Investors added a net A$470m to their holdings. Calastone’s detailed analysis of individual fund transactions revealed that infrastructure funds were responsible for all of this sector-focused cash – other specialist sector funds such as mining, industrials and healthcare saw outflows.

Marsha Lee, Director, Australia and New Zealand at Calastone said, “The bond markets are in the driving seat for the time being – and bond yields are essential to calculating what equities should be worth. One moment, inflation comes in better than expected or central banks hitting pause on interest rates causes a bond market rally. This, along with investor hopes for a soft economic landing, gives equities a boost. The next moment, policymakers take the punchbowl away with a warning that rates will stay high for the foreseeable future – bond yields surge and equity markets sag.

“The stock market in Australia and around the world duly fell in August and September, turning what was already a lacklustre start to the financial year into a distinctly soggy one.

“Infrastructure tends to do better than general equities in periods of low growth and high inflation. This reflects long-term (and often regulated) contracts, while many projects also have inflation protection built into their pricing. High long-term interest rates are not helpful to asset valuations, but investors may consider infrastructure to be a relative safe haven in volatile times.”

Fixed income funds saw large inflows in Q3 2023, but buying petered out by September as bond markets faltered.

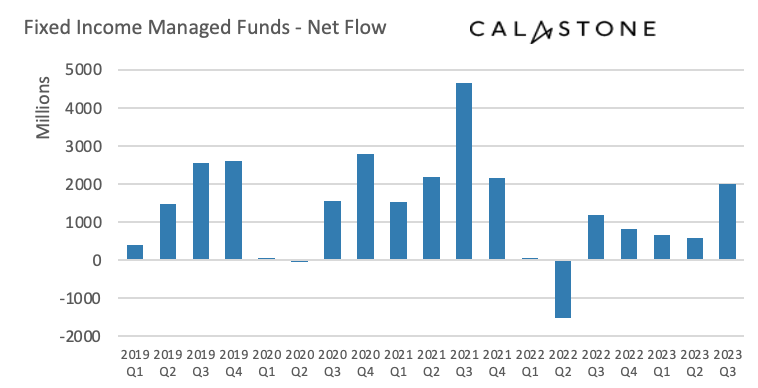

Net fixed income managed fund flows, Q3 2023

Among other asset classes a sharp inflow of capital to bond funds in July and August had given way to modest outflows by September, reflecting the air of capitulation in the bond markets as the notion that rates will stay higher for longer gained ground. The good start to the quarter nevertheless made the A$2bn inflow for Q3 the highest since the last quarter of 2021.

Marsha Lee added, “Bond investors are juggling the attraction of locking into high yields now with the apparently receding prospect of capital gains in the short term. Momentum is against them for now. Clear signs of sustained disinflation accompanied by a definitive turn in the rate cycle are top of the wish list for market bulls at present, but central bankers, including at the RBA, are suggesting that the time has not yet come.”

Property funds saw their worst quarter on Calastone’s record

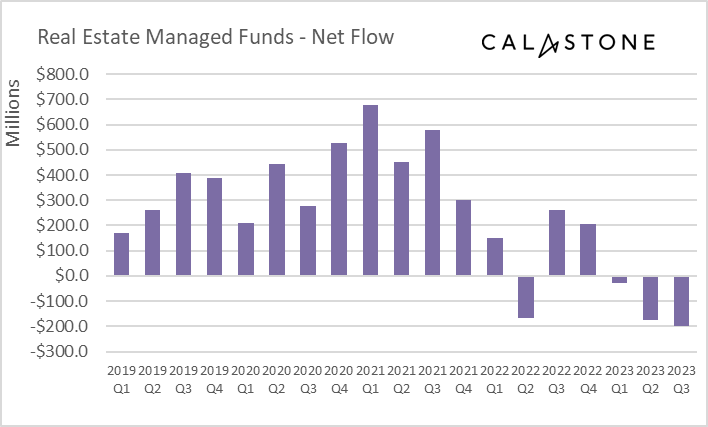

Property funds also had a tough quarter. Outflows of A$199M were the largest on record, and Q3 was the third consecutive quarter to see outflows.

Net real estate managed fund flows, to Q3 2023

“Commercial property values were very hard hit in the second half of 2022, both in Australia and internationally as the market adjusted to the sharply higher interest rate environment. In 2023, values have seen much more modest declines, but investors seem in no mood to dip their toes back in. Property tends to have lots of borrowing so higher rates are hitting cash flows in the sector as well as asset valuations, while a slowing economy is bad for tenant demand,” Marsha said.

Mixed asset funds fall firmly out of investor favour

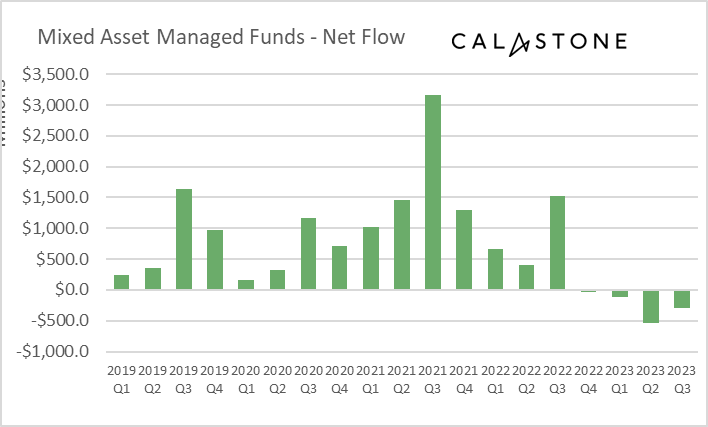

Net multi-asset managed fund flows, Q3 2023

Mixed asset funds suffered their fourth consecutive outflow in Q3, the longest run on Calastone’s record. They shed A$288m, taking the total for the last 12 months to A$974m. September was the worst month on Calastone’s record for the sector. Indeed, between 2019 and 2021, only one month had ever seen outflows from mixed asset funds. Since the beginning of 2023, by contrast, six months have seen net selling.

Marsha Lee explained: “Mixed asset funds were created to benefit from the way equities and bonds have traditionally moved – when one goes up, the other had tended to go down. This meant you could achieve a better return for a chosen level of risk. The trouble is that bond and equity markets have moved largely in tandem in the last eighteen months or so which is leading investors to question whether they can do better elsewhere for a similar risk profile. This reappraisal is clearly driving investors out the doors. Mixed asset funds used to enjoy steady inflows month in, month out, as investors had them cemented into savings plans, but this no longer seems to be the case.”

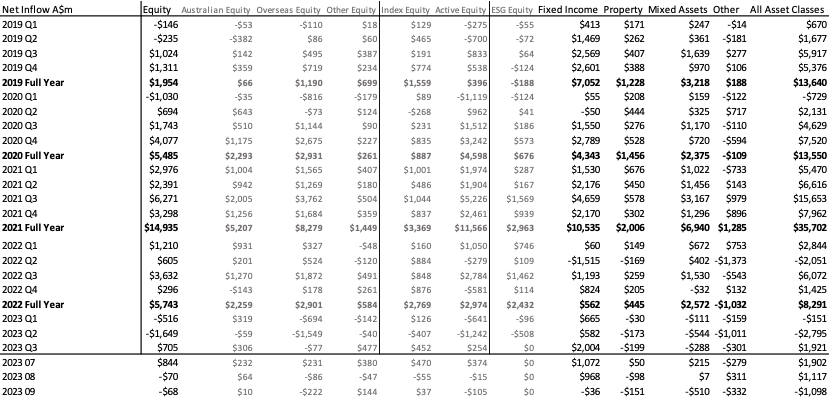

Fund Flow Data recorded across the Calastone Network (A$m) Q1 2019 to Q3 2023

Methodology

Calastone analysed over half a million buy and sell orders every month from January 2019, tracking capital from advisers, platforms and as it flows into and out of managed funds. Data is collected until the close of business on the last day of each month. A single order is usually the aggregated value of a number of trades from underlying investors passed for example from a platform via Calastone to the fund manager. In reality therefore, the index is analysing the impact of many millions of investor decisions each month.

More than 95% of Australian managed fund flows pass across the Calastone network each month. All these trades are included in the FFI. To avoid double-counting, however, the team has excluded deals that represent transactions where funds of funds are buying those funds that comprise the portfolio.

The index is a measure of investor conviction, placing the net flow of capital into the context of overall trading volumes. It also allows the reader to compare flows in asset classes of different sizes – A$100m of inflows may be very large for a small, relatively new asset class like ESG equity but very small for a huge category like fixed income. A reading of 50 indicates that new money investors put into funds equals the value of redemptions (or sales) from funds. A reading of 100 would mean all activity was buying; a reading of 0 would mean all activity was selling. In other words, $1m of net inflows will score more highly if there is no selling activity, than it would if $1m was merely a small difference between a large amount of buying and a similarly large amount of selling.

Calastone’s FFI considers transactions only by Australia-based investors placing orders for funds domiciled in Australia. The majority of this capital flow is advised and via platforms.