Frollo research reveals the rise of ‘Invisible Debt’ and Associated Risks

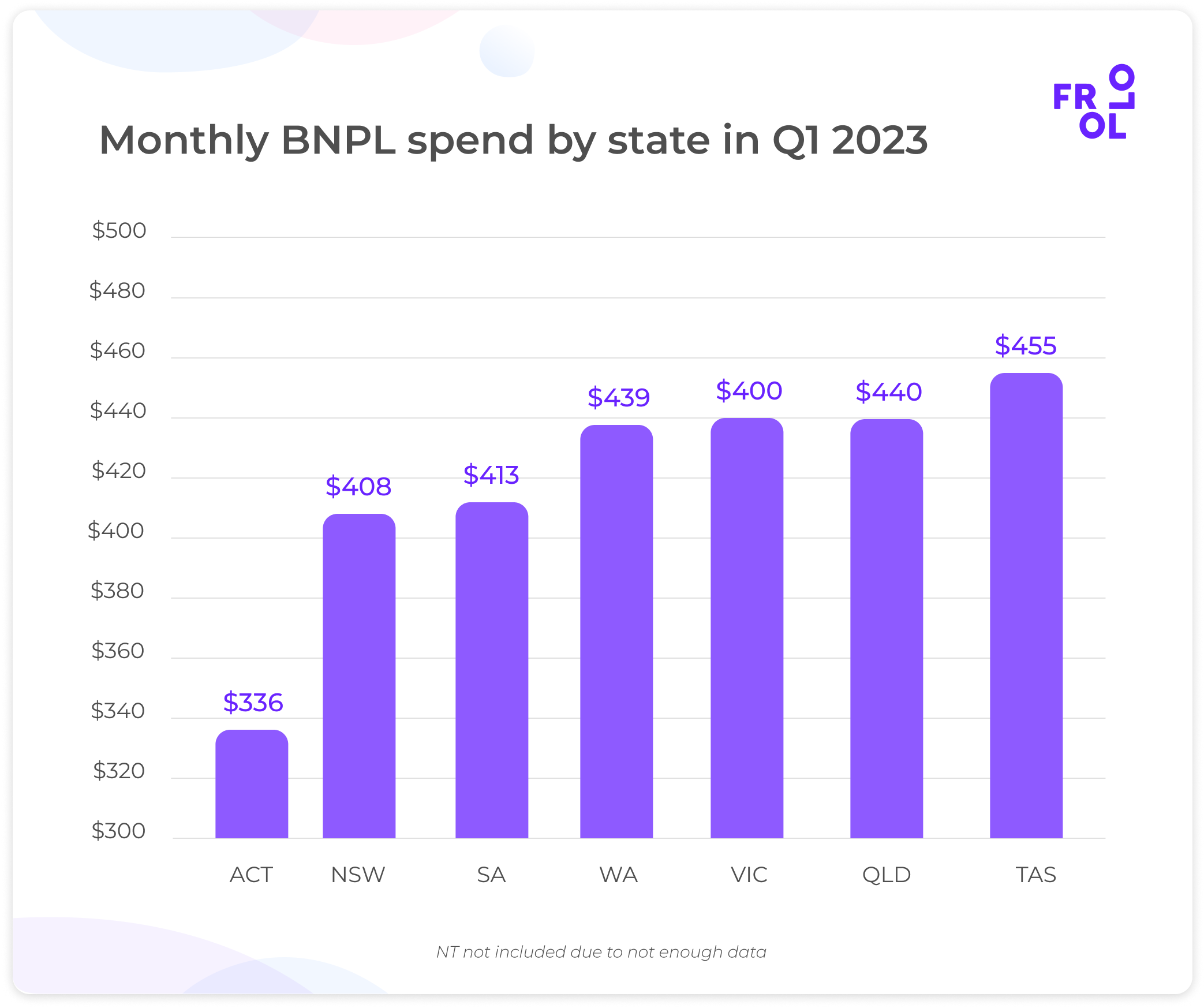

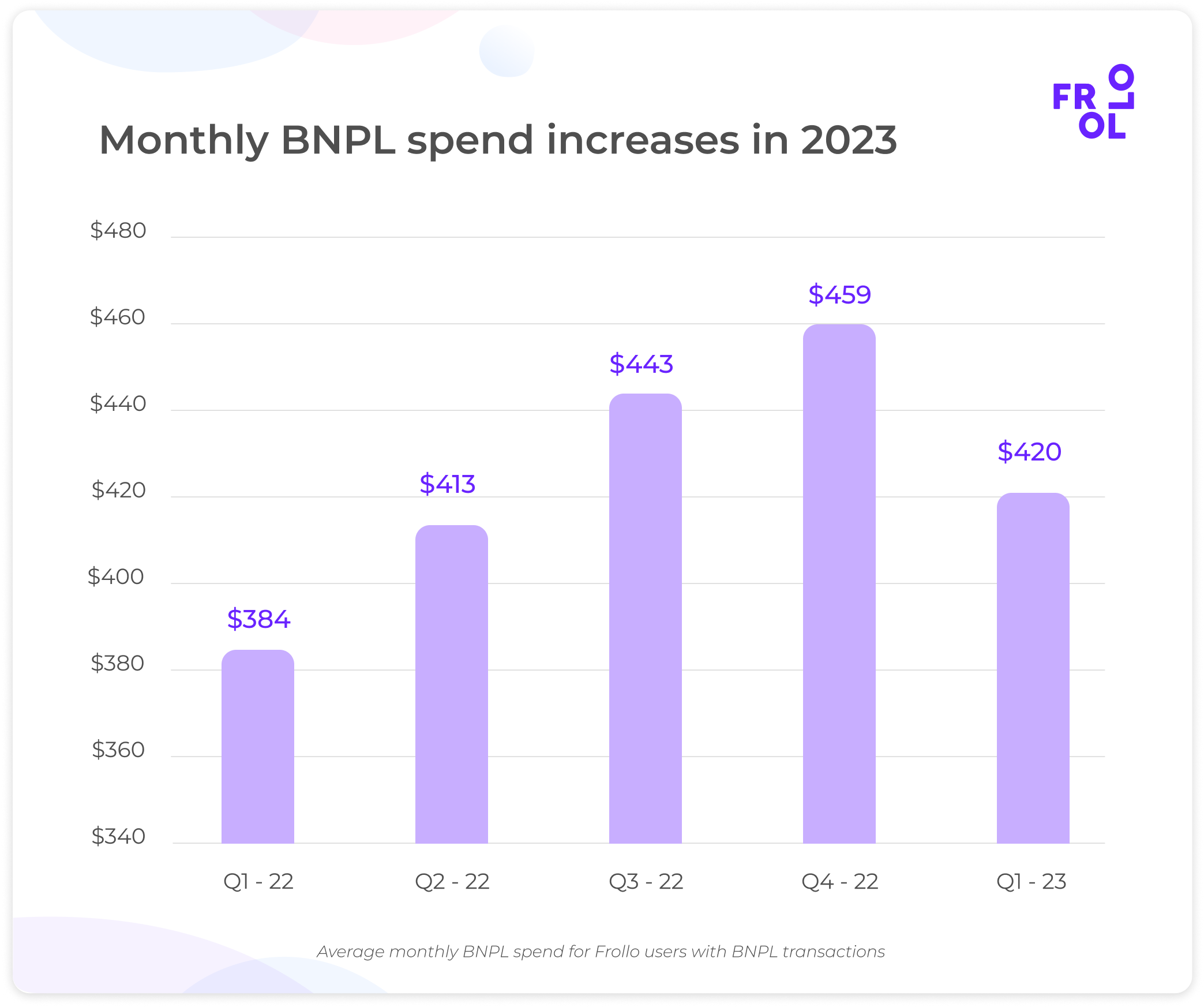

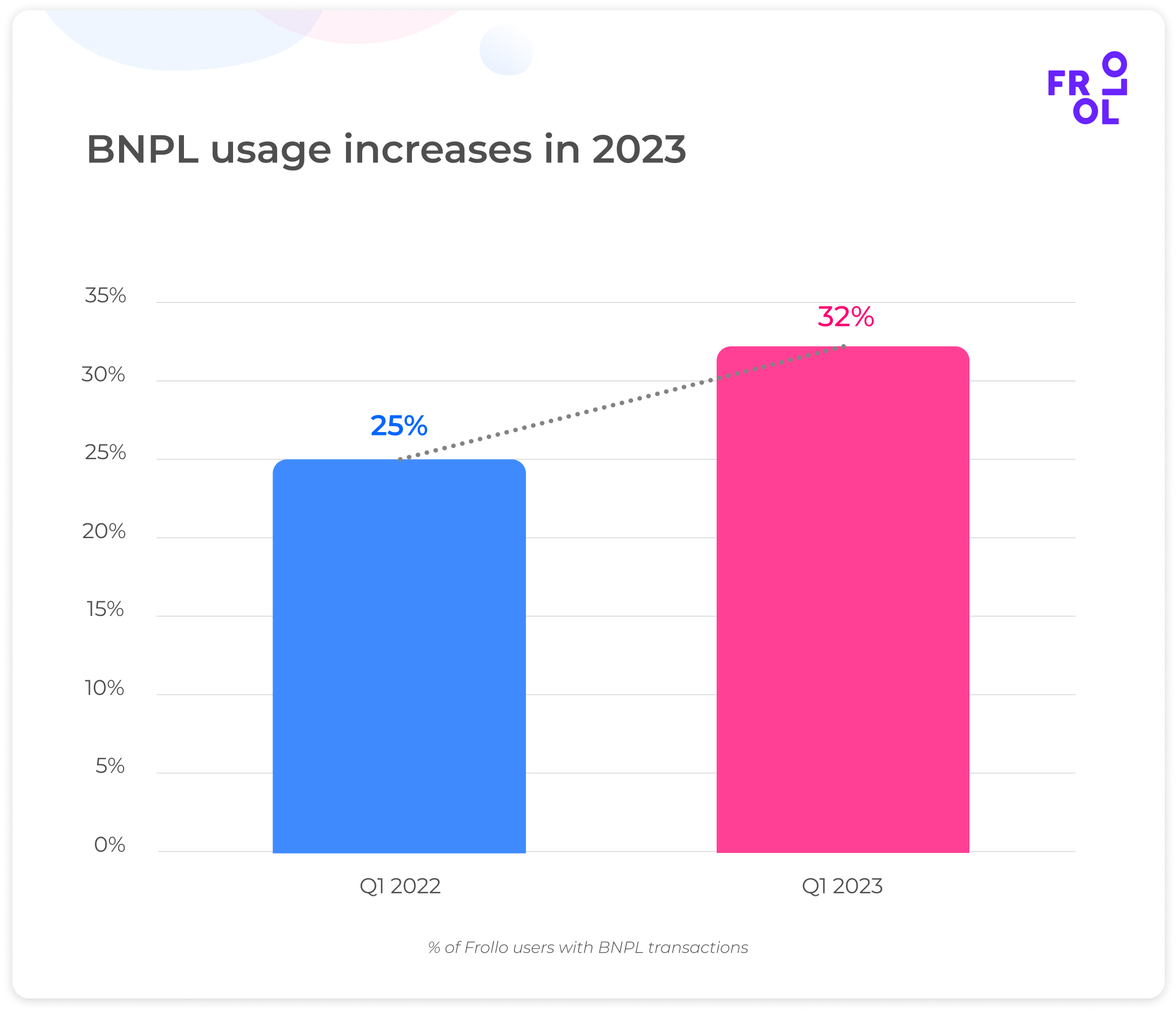

Frollo, a leading open banking technology provider, has released new research indicating a concerning rise in the usage of unregistered credit like Buy Now Pay Later (BNPL) and Pay Advance services. Research shows in Q1 2023, the number of BNPL users increased to 32% from 25% in Q1 2022, with an average monthly spend of $420 per user.

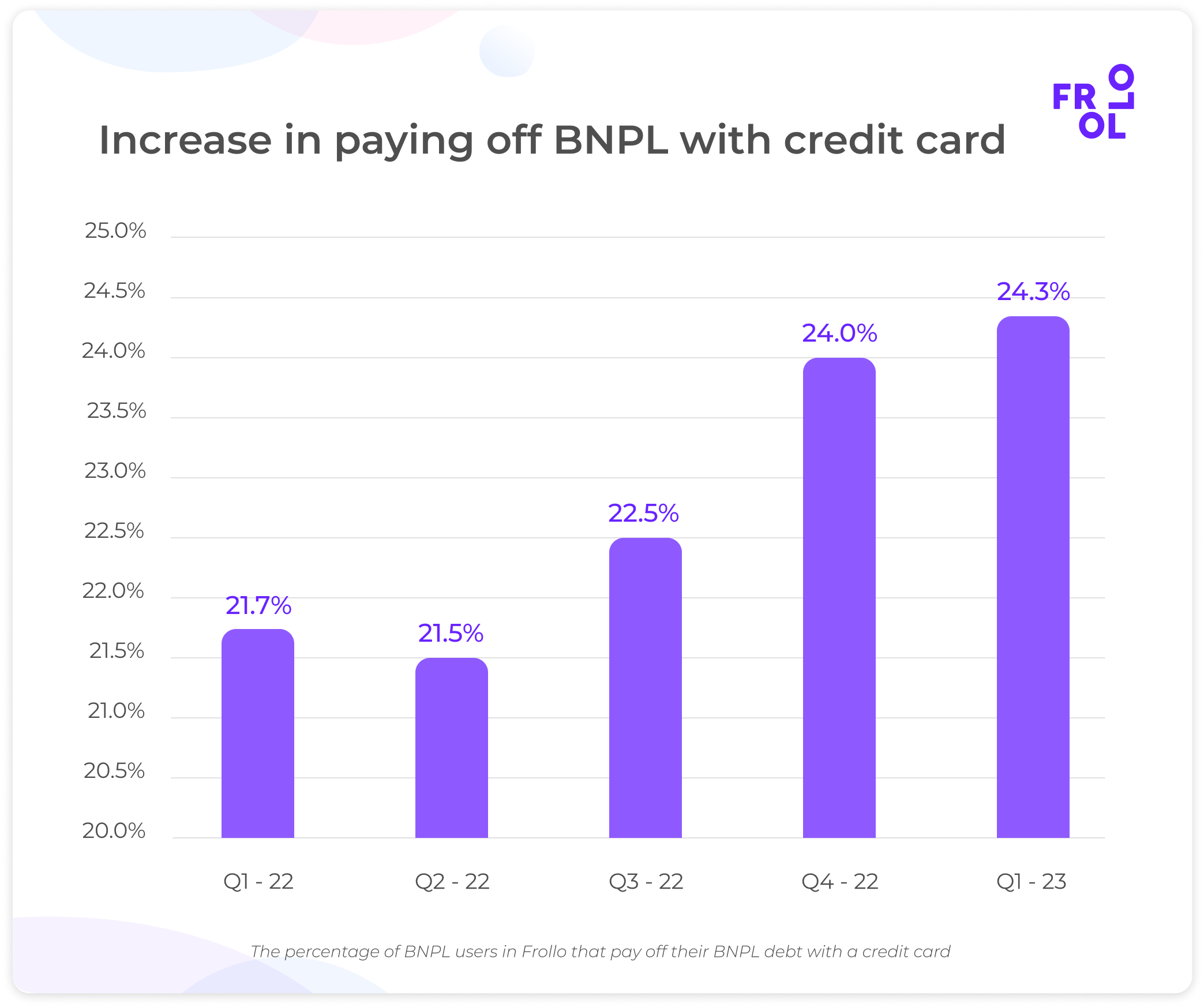

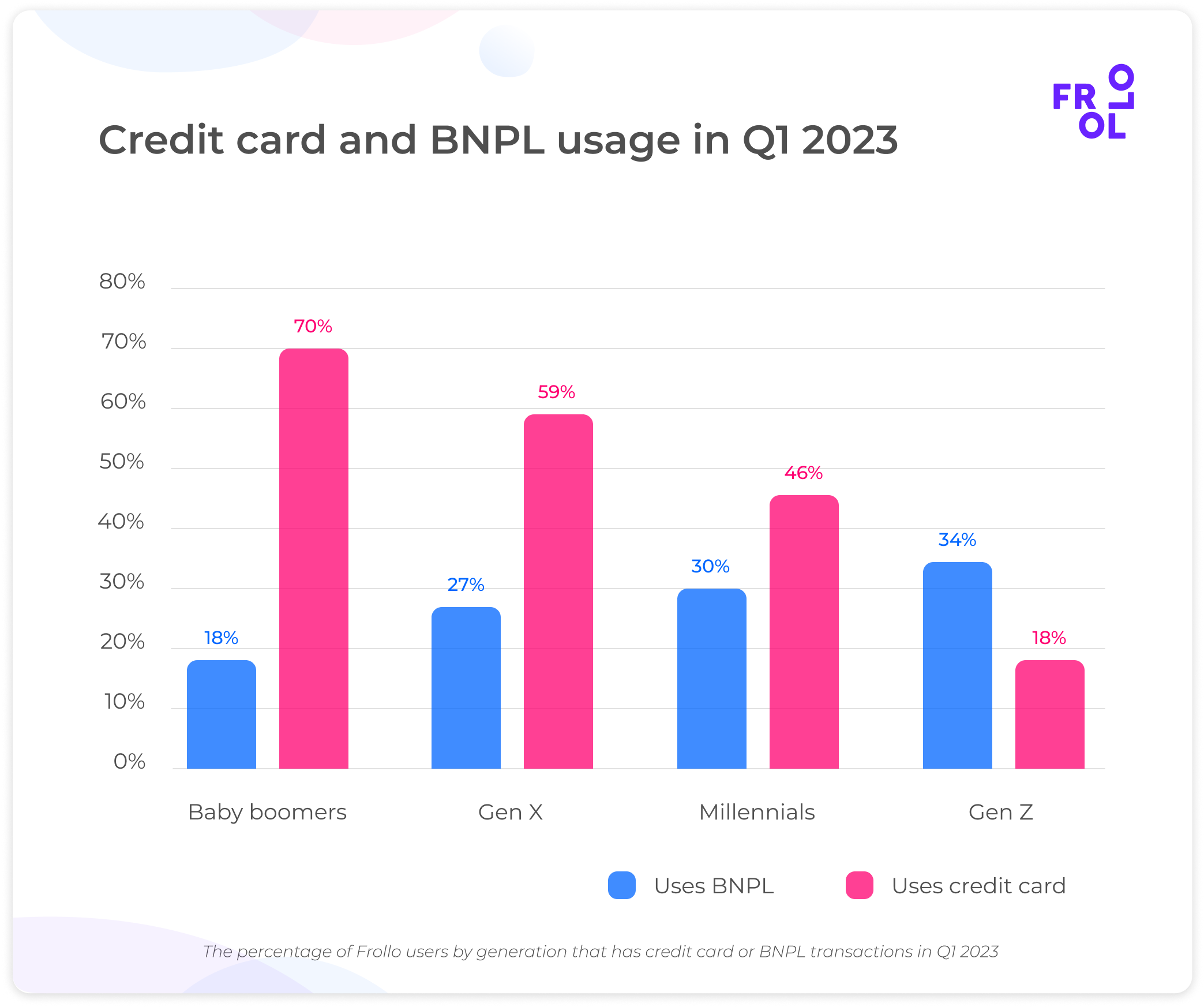

Furthermore, the research shows almost a quarter of BNPL users pay off their debt with a credit card, potentially creating a vicious cycle of debt for consumers. While younger generations, particularly Gen Z, are more likely to use BNPL, Baby boomers and Gen X are more likely to pay off their BNPL debt with a credit card.

The research validates a worrying trend in the fact that most BNPL and Pay Advance providers do not perform credit checks or report the debt to credit bureaus, making it difficult for other lenders to assess a borrower’s ability to repay their debts.

Increased Pay Advance Spending

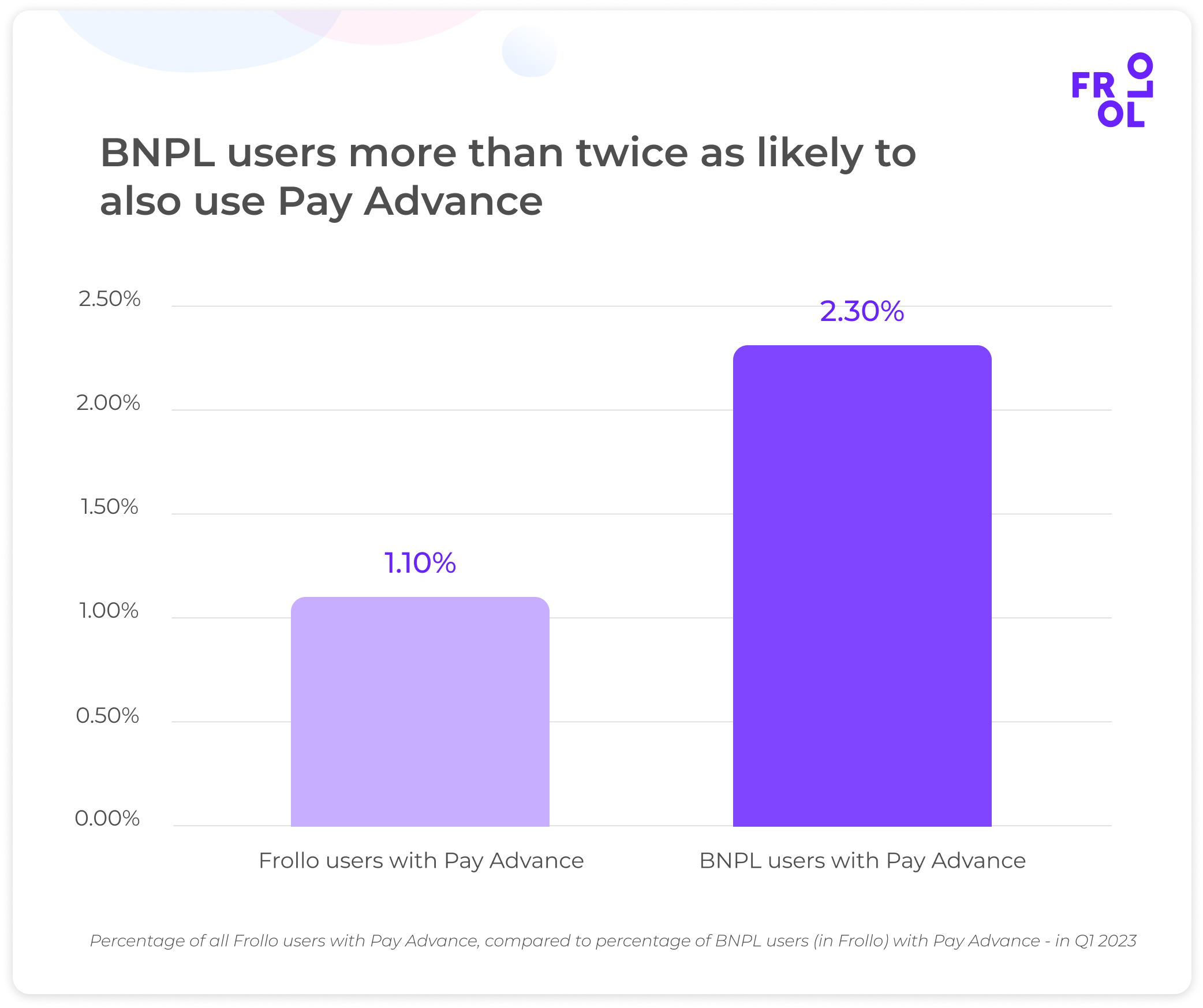

BNPL users are more likely (2.3%) to use Pay Advance (short-term credit) than other users, which has remained stable at 1.1%. However, the average Pay Advance user now spends $749 per month on repayments and fees, up by 60% compared to Q1 2022. This increase may be due to the continued cost of living pressures and rising interest rates.

Risks for Consumers and Lenders

Despite their apparent convenience, Frollo is warning that the unregistered nature of BNPL and Pay Advance services carries material risks for both consumers and lenders. The lack of credit checks and reporting to credit bureaus can make it difficult for other lenders to assess a borrower’s ability to repay their debts, potentially leading to lending to those who can’t afford it.

Paying Credit with Credit

The research also highlights generational differences in BNPL and credit card usage. Younger generations, particularly Gen Z, are more likely to use BNPL services, with 34% of Gen Z using it compared to 18% of baby boomers. Conversely, credit card use is more popular among baby boomers, with 70% of them using it compared to only 18% of Gen Z. Furthermore, Frollo’s research shows that almost a quarter of BNPL users (24.1%) pay off their BNPL debt with a credit card, potentially creating a vicious cycle of debt for consumers, making it difficult to manage their finances effectively.

Mitigating Risks with Open Banking

Simon Docherty, Chief Commercial Officer at Frollo, stated that BNPL and Pay Advance services pose a higher risk for both consumers and lenders

“Fortunately, Open Banking provides lenders with a secure and complete financial picture of any potential customer, including payment history with BNPL and Pay Advance providers, as part of the credit application process,” he said.

“As BNPL and Pay Advance services continue to gain popularity, Frollo’s research highlights the associated risks for both consumers and lenders. With regulation underway, lenders must employ the necessary tools and technology to accurately evaluate affordability and risk.

“Open Banking can play a crucial role in mitigating these risks by providing lenders with a complete financial picture of their potential customers.”