Frollo finds St. George Bank leads the way for providing Open Banking data

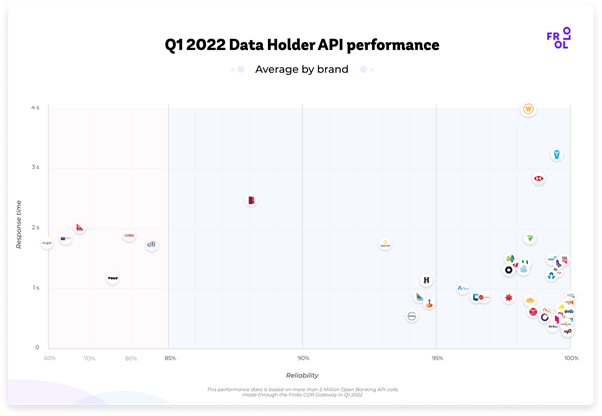

An analysis by Frollo, the leading provider for Open Banking in Australia, shows that the number of fast and reliable Data Holders has significantly increased in Q1 of 2022. Almost half (22 out of 45) of the Data Holders provided Open Banking transaction data in less than 1 second on average, up from 16 Data Holders in 2021.

Reliability – the percentage of successful API calls – was also up, with 40% of banks scoring 99% or more, up from 22% of banks in 2021.

Data completeness in Open Banking

Open Banking has the potential to offer a rich and deep dataset to build innovative and personalised experiences. Though, to build those experiences it’s important a business can count on the data being available, regardless of which Data Holder the customer connects to.

Unfortunately information about what data is actually being provided, hasn’t been easily accessible – until now.

In an ongoing effort to help build and improve the CDR ecosystem, Frollo has performed an initial analysis into Open Banking API payloads and properties, as part of its Open Banking API performance reporting.

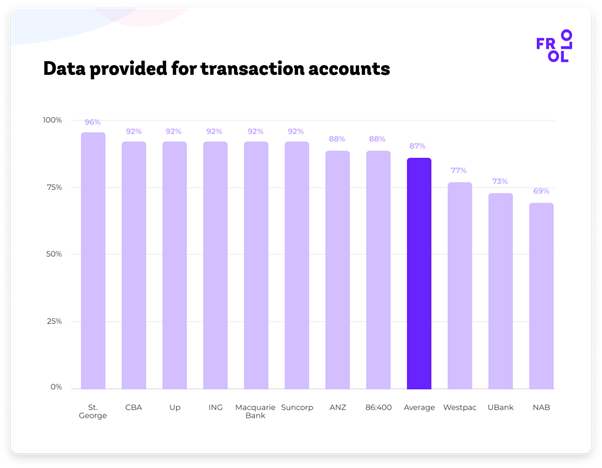

This initial analysis compares API payloads for transaction accounts by 11 popular Data Holders, to see how many of 26 selected properties they provide. It only includes quantitative data; quality will be assessed in a future analysis.

The 26 properties form a set that enables a typical personal finance management use case with expense categorisation, spend insights, bill tracking and product comparison.

The following properties were included:

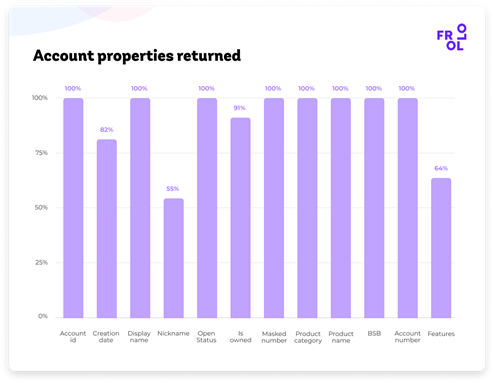

- Account information: Account id, creation date, display name, nickname, open status, is owned, masked number, product category, product name, bsb, account number and features

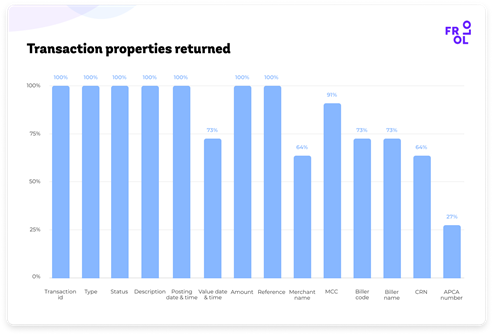

- Transaction information: Transaction id, type, status, description, posting date & time, value date & time, amount, reference, merchant name, merchant category code, biller code, biller name, crn and APCA number

For each Data Holder a large number of transactions related to their transaction accounts were reviewed to determine which of the properties in the set are provided by the Data Holder for transactions where this would be expected. Although this analysis has a purely quantitative focus, following analyses will include qualitative elements as well.

Overall results

15 out of the 26 selected properties are provided by all of the Data Holders in this analysis. The properties that are most often missing are APCA number (provided by 27% of Data Holders), merchant name (64%), account nickname (55%) and product features (64%). Properties related to billers are provided by less than 3 out of 4 Data Holders. Biller code and biller name are both provided by 73%.

Results by Data Holder

Out of the Data Holders included in Frollo’s analysis, St. George Bank provides most of the data (96%), while NAB (69%) and UBank (73%) trail behind. 6 out of the 11 Data Holders provide more than 90% of all selected properties for a typical pfm use case.