Frollo calls for government consumer awareness campaign as more businesses embrace Open Banking

Open Banking provider Frollo has published its yearly ‘State of Open Banking’ report, providing a pulse check of the Open Banking industry in Australia. The report shows an industry with all the ingredients for success, but one: Consumer awareness. With recent high-profile breaches at Optus and Medibank in mind, consumers must be made aware of this secure, government-regulated alternative to sharing bank credentials with third parties.

Fast, reliable and rich data, but mind the gap(s)

Frollo’s report shows that more than 100 banks are now using Open Banking to share data for over 30 different financial products, covering 99%+ of all Australian household deposits. This includes several mobile-only banks that aren’t available via screen-scraping, but doesn’t yet include non-bank lenders and superannuation.

APIs are fast and reliable, with the average Data Holder providing data in 0.97 seconds, with 98% reliability. 64% of Data Holders provide data in less than 2 seconds with 95%+ reliability, but some banks are either slower, less reliable or both.

An analysis of 25 Data Holder API payloads for transaction and mortgage accounts shows that the data provided is rich, but has some gaps. Those gaps are especially visible when it comes to mortgages, where information about minimum repayment, original loan amount and maximum redraw amounts isn’t reliably provided by all banks.

New access models are driving a growing ecosystem

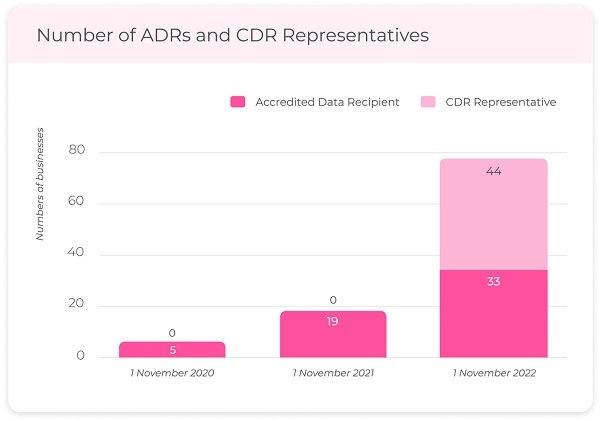

In the past 12 months, industry interest in Open Banking has translated to action: The number of businesses able to access Open Banking data has more than quadrupled from 19 to 77!

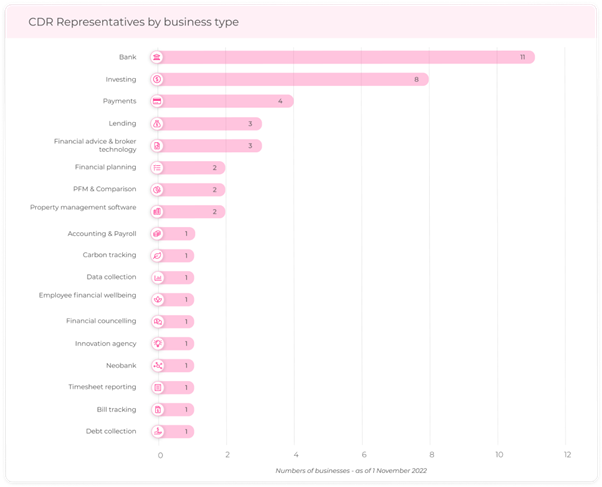

The number of Accredited Data Recipients (ADR) grew from 19 to 33, most of which are Open Banking providers, banks and personal finance management / comparison websites. A whopping 44 businesses have registered as CDR Representatives to gain access to Open Banking data. Treasury launched this access model in February 2022 to make it easier for a wide range of businesses to use Open Banking data. So far, it is delivering as promised., with 44 CDR Representatives, including 18 different business types. Investing, payments, lending and financial advice & broker technology are some of the most popular categories.

Consumers value the benefits of Open Banking

Frollo surveyed 1,066 Australians from all walks of life about financial data sharing, potential use cases, the things they find important when sharing their data and who they trust with it.

The research shows that Open Banking solves an essential problem for consumers:

- 61% want to use Open Banking to get a complete financial overview in one place, and 59% want to use it to streamline their mortgage application.

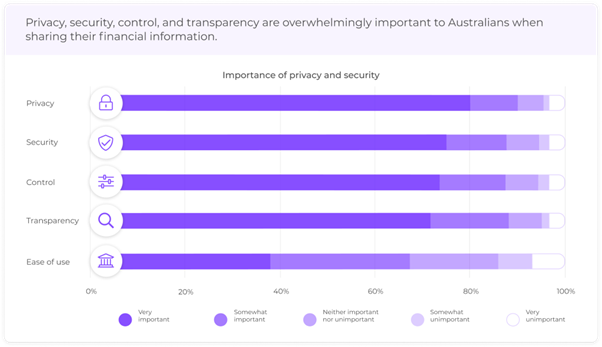

- When it comes to sharing financial information, privacy is the most important consideration for 91% of consumers. Other key priorities are security (88% of respondents), control (88%) and transparency (88%).

It’s time for a consumer awareness campaign

Frollo CEO Tony Thrassis explains why it’s time for the government to start educating consumers about Open Banking, “Open Banking promises to put consumers in control of their data by providing them with a secure, government-regulated way to use it. All the ingredients to deliver on this promise are available, except one: Consumers don’t know about Open Banking. And after years of being told not to share their financial information, they’re understandably cautious. With the initial roll-out complete, businesses launching use cases and consumers showing real interest, now is the time for the government to start educating consumers about the secure, government-regulated alternative to sharing banking passwords. If recent high-profile security breaches have told us anything, it’s the importance of data security and privacy.”