Limepay chooses Google Cloud to power the future of digital payments

Limepay has partnered with Google Cloud to upgrade and run its technology platform, and ultimately help design the future of digital payments.

CBA introduces leading AI technology to protect more customers from scams

Commonwealth Bank has introduced new AI technology to detect suspicious and unusual behaviour on its digital banking platforms.

Australian fintech Spenda announces company rebrand

ASX-listed fintech Spenda has announced a full company rebrand that represents and aligns the continued evolution and growth of the business.

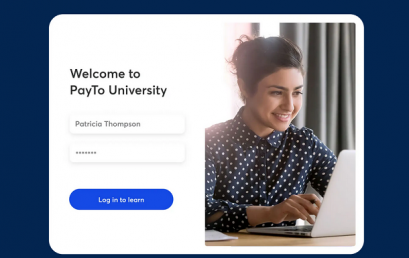

GoCardless launches free online course ‘PayTo University’ to support introduction of Australia’s new payment system

GoCardless launches PayTo University; a free online course designed to assist businesses to get up to speed with the Australia’s payment infrastructure.

Australian crypto startup CryptoSpend in growth mode

Australian crypto startup Cryptospend have just launched their first national advertising campaign.

PayTo commences rolling out for first payment service providers

NPP Australia has confirmed that the first payment service providers to offer PayTo to merchants and businesses in coming months.

Airwallex launches its global payment services in New Zealand

Leading financial platform Airwallex today announced the launch of its global payment services in New Zealand.

Zip responds to Australian Finance Industry Association report on the economic impact of the BNPL industry in Australia

Zip welcomes Australian Finance Industry Association research showing BNPL is a vital part of the Australian financial ecosystem.