Visa, Uber and PayPal are reportedly backing Facebook’s Cryptocurrency

The WSJ reports that among those that bought into Facebook’s cryptocurrency are Visa, Mastercard, PayPal, Uber, Stripe, Booking.com and MercadoLibre.

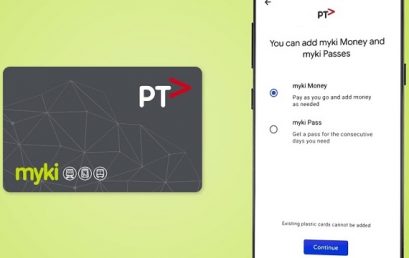

Victorians flock to Google Pay myki alternative

The number of Victorian commuters using Google Pay for public transport is nearing 100,000, just 11 weeks into the state’s new cardless myki scheme.

Opal card integration with Apple Pay, Google Pay? Dominello dares to dream

Commuters hoping to ditch their physical Opal smartcard for a virtual equivalent in a digital wallet could be waiting some time yet.

Visa B2B Connect launches globally

Visa launches the Visa B2B Connect network, giving financial institutions an ability to securely process high-value corporate cross-border payments globally

Global digital remittances forecast to reach US$525 billion by 2024: report

International digital remittances will reach US$525 billion by 2024 as traditional players in the market face fintech challenges, according to a new research report.

A record $117 billion in fintech deals have been done this year as cashless payments soar in popularity

Fintech-targeted mergers and acquisitions has increased rapidly over the last five years, and the value of deals in the space has hit a record high in 2019

Afterpay, Zip propping up sluggish retail sales

In the six months to December 2018, listed buy-now, pay-later providers Afterpay and Zip accounted for about 16% of the growth in retail spending.

Verrency reaches a milestone with over 30 strategic partners

Verrency has secured 32 strategic partners to leverage the company’s enterprise grade, curated API capabilities at financial institutions.